Free Loan Agreement Template

Introduction: A loan agreement is commonly used for loans that require repayment over time or any amount of money, these can be personal loans, or business loans. Typical loans also carry interest rates which can vary based on the lender and the duration of the loan. These could be a small business start-up loan, student loans, a loan for real estate purchase (which are typically a ‘term loan’, such as 5 year, 15 year, and 30 year), student or educational loans, loans for a large purchase (car, furniture, etc.), or simply a private loan between family members or friends. Having a written loan agreement benefits both the borrower and the lender. For the borrower it helps keep track of the payment schedule and confirms the lender’s agreement to the payment terms. For the lender it helps enforce the borrower’s promise to pay back the loan and allows recourse in case the borrower fails to make payments or defaults on the loan. Key Points:

- Any changes to the terms of the loan contract should be made in an amendment and signed by both parties.

- Unless a more complicated agreement is necessary, a loan agreement should simply outline the principal and interest, if any, that is to be loaned.

- Repayment terms should be clearly specified.

- Late fees should be outlined as well, as there are usually penalties for late payment or non-payment.

- Depending on the loan type, there may be fixed rates or adjustable rates due to certain factors, whether tied to financial markets, or based on certain criteria being met.

Helpful Information: An old saying is “good fences make good neighbors.” The same can be said when it comes to financial matters. Any loan should in writing so that each party is fully aware of the terms being entered into and they can be referred back to with precision. This protects both parties from later claiming they did not understand the terms of the arrangement. If necessary, seek legal advice until both parties are comfortable with the terms. There are also loans where there is a lump sum handed out, such as a line of credit, as well as recurring loans where payment is made over a period of time on behalf of someone, such as with some student loans. Signature: A secure method to get an agreement signed is online. Online signatures of the parties are legally binding. This is a convenient way to expedite the process and eliminate stress for both you and the client. You can use ApproveMe.com to ensure you have a legally binding signature.

Your Signing experience is worth celebrating!

ApproveMe is easy document signing for busy people. Built on the belief that every new agreement with a customer or client should be celebrated.

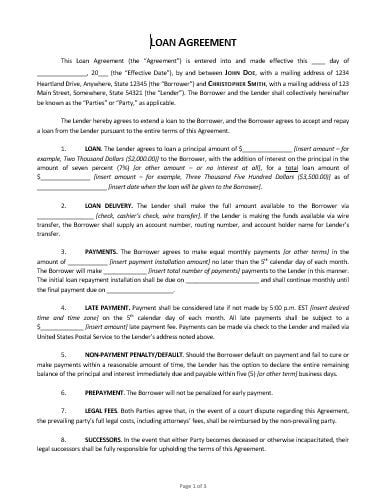

Loan Agreement

This Loan Agreement (the “Agreement”) is entered into and made effective this ____ day of _______________, 20___ (the “Effective Date”), by and between John Doe, with a mailing address of 1234 Heartland Drive, Anywhere, State 12345 (the “Borrower”) and Christopher Smith, with a mailing address of 123 Main Street, Somewhere, State 54321 (the “Lender”). The Borrower and the Lender shall collectively hereinafter be known as the “Parties” or “Party,” as applicable. The Lender hereby agrees to extend a loan to the Borrower, and the Borrower agrees to accept and repay a loan from the Lender pursuant to the entire terms of this Agreement.

- LOAN. The Lender agrees to loan a principal amount of $_______________ [insert amount – for example, Two Thousand Dollars ($2,000.00)] to the Borrower, with the addition of interest on the principal in the amount of seven percent (7%) [or other amount – or no interest at all], for a total loan amount of $_______________ [insert amount – for example, Three Thousand Five Hundred Dollars ($3,500.00)] as of _____________________ [insert date when the loan will be given to the Borrower].

- LOAN DELIVERY. The Lender shall make the full amount available to the Borrower via _________________ [check, cashier’s check, wire transfer]. If the Lender is making the funds available via wire transfer, the Borrower shall supply an account number, routing number, and account holder name for Lender’s transfer.

- The Borrower agrees to make equal monthly payments [or other terms] in the amount of ____________ [insert payment installation amount] no later than the 5th calendar day of each month. The Borrower will make _____________ [insert total number of payments] payments to the Lender in this manner. The initial loan repayment installation shall be due on ______________________ and shall continue monthly until the final payment due on ____________________.

- LATE PAYMENT. Payment shall be considered late if not made by 5:00 p.m. EST [insert desired time and time zone] on the 5th calendar day of each month. All late payments shall be subject to a $_____________ [insert amount] late payment fee. Payments can be made via check to the Lender and mailed via United States Postal Service to the Lender’s address noted above.

- NON-PAYMENT PENALTY/DEFAULT. Should the Borrower default on payment and fail to cure or make payments within a reasonable amount of time, the Lender has the option to declare the entire remaining balance of the principal and interest immediately due and payable within five (5) [or other term] business days.

- PREPAYMENT. The Borrower will not be penalized for early payment.

- LEGAL FEES. Both Parties agree that, in the event of a court dispute regarding this Agreement, the prevailing party’s full legal costs, including attorneys’ fees, shall be reimbursed by the non-prevailing party.

- SUCCESSORS. In the event that either Party becomes deceased or otherwise incapacitated, their legal successors shall be fully responsible for upholding the terms of this Agreement.

- NOTIFICATIONS. Any communication or notification related to this Agreement shall be made as follows:

If to the Lender: Christopher Smith 123 Main Street Somewhere, State 54321 If to the Borrower: John Doe 1234 Heartland Drive Anywhere, State 12345

- ENTIRE AGREEMENT.The Parties acknowledge and agree that this Agreement represents the entire agreement between the Parties. In the event that the Parties desire to change, add, or otherwise modify any terms, it shall be done so in writing and signed by both Parties.

- REPRESENTATIONS AND WARRANTIES. Both Parties represent that they are fully authorized to enter into this Agreement. The performance and obligations of either Party will not violate or infringe upon the rights of any third party or violate any other agreement between the Parties, individually, and any other person, organization, or business or any law or governmental regulation.

- In the event any provision of this Agreement is deemed invalid or unenforceable, in whole or in part, that part shall be severed from the remainder of the Agreement and all other provisions should continue in full force and effect as valid and enforceable.

- The failure by either Party to exercise any right, power or privilege under the terms of this Agreement will not be construed as a waiver of any subsequent or further exercise of that right, power or privilege or the exercise of any other right, power or privilege.

- GOVERNING LAW AND JURISDICTION. This Agreement shall be construed and governed by the laws of the state of ________________ [insert state of Lender] without regard to principles of conflicts of law.

IN WITNESS WHEREOF, the Parties as identified below have executed this Agreement as of the Effective Date of this Agreement. “BORROWER” JOHN DOE _____________________________________________ Signature “LENDER” CHRISTOPHER SMITH ___________________________________________ Signature

Frequently Asked Questions

What is a Loan Agreement?

The loan agreement will include all of the terms and conditions for borrowing money, including how much money is being borrowed, what interest rate will be applied to the loan, what collateral will be used to secure the loan, what repayment schedule has been agreed upon by both parties, and other details.

How do I write a Loan Agreement?

The first step in writing a loan agreement template is to identify the key terms, such as:

-Purpose of the loan

-Amount of the loan

-Term of the loan (length)

-Rate of interest charged on unpaid balances

-Repayment schedule (how often repayments are made)

-Loan security (collateral for repayment)

-Events that trigger default interest rates or other penalties, such as late payments or missed payments.

How do I draft a friendly loan agreement?

- The names of the parties involved in the agreement

- The amount of money to be borrowed by the borrower

- The interest rate to be charged on the loan

- The length of time over which payments will be made

- A detailed explanation of how any interest will be calculated and collected.

What is the difference between a loan agreement and a promissory note?

A loan agreement is an agreement between two parties where one party provides money to another party in return for future repayment with interest.

The difference between a loan agreement and promissory note is that, while both are agreements, they differ in terms of how they are structured. A loan agreement involves an exchange of money for goods or services, whereas a promissory note does not involve any kind of exchange.

how to write a loan agreement

A well-written loan agreement template will reduce risk for both parties by outlining expectations and providing clear instructions for how to proceed with repayment. You can download the loan agreement template on this page to have an easy starting point.

how to write a loan agreement template

The template on this page includes the main sections and information that your agreement can have. After you download this template, read it carefully, and add your specific information to make sure it meets your needs.

how to draw up a loan agreement between friends

A loan agreement between friends should be as simple as possible. It should include the following:

- The amount of money borrowed

- The length of the repayment period

- The interest rate

- What happens if there is more than one repayment period?

what is a demand loan agreement?

A demand loan agreement can be used in cases where the borrower needs cash now but doesn't want to risk paying more in interest than they would need to pay if they waited for an installment loan.

The agreement spells out the terms of the deal and how much money will be lent, when it will be paid back, and how much it will cost in interest. It also lays out what happens if you don't repay your debt or there is any other disagreement between you and the lender.

what is a loan agreement and why is it important?

The loan contract is important because it ensures that both parties are in agreement on what they are borrowing and how much they will have to pay back. It also protects both parties by setting out the obligations of each party in detail.

how to make a loan agreement letter

The letter should be signed by both parties and dated with an original signature. Some factors that can help you decide on what needs to be included in a loan agreement letter are:

-The type of loan (business, personal, etc)

-The need for insurance

-The repayment schedule (weekly, monthly)

-Whether or not there is a pre-payment penalty

-Whether or not there are any penalties for late payments

how to write a family loan agreement

The agreement should include details about the type of loan, how much will be borrowed, repayment terms and interest rates, collateral and other relevant information.

how to write up a loan agreement

This is a very important document that both parties should take time to read and understand before signing. The agreement should include:

- The amount of money that is being lent

- The interest rate on this money

- The length of time for which this money will be lent

- How often payments will be made

- What happens if there are late payments or defaults on payments

can you cancel a loan agreement?

how to write a loan agreement with collateral

A collateral is an asset that can be seized by a lender to guarantee repayment of debt in case of default. Collateral can be either tangible or intangible assets. Tangible collateral includes things like cars, houses, jewelry, and furniture. Intangible collateral includes things like stocks or bonds.

how to write a simple loan agreement

- The amount of money

- The terms of repayment

- The interest rate, if applicable

- A statement that the borrower agrees to pay back the loan, with interest

Why do I need a free loan agreement template?

Send Contracts in Minutes

Unlock the power of WP E-Signature on your website using your branding today!

Get Started Now