Loan Document Tips

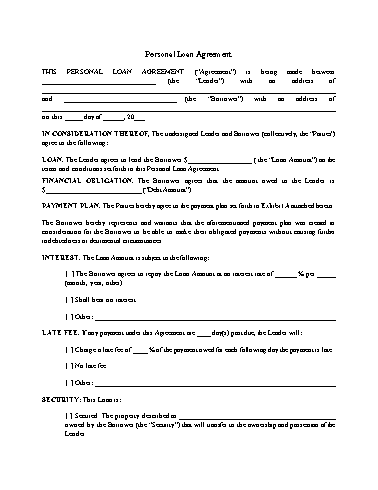

Promissory Note

A Promissory note is a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan. A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. If you are lending a large amount of money to someone (or to a business), then you may want to prepare a promissory note to document the transaction. This note will be a legal record of the loan and will protect you and help make sure you are repaid. A promissory note sets out all the terms and details of the loan. The promissory note should include:

- The names and addresses of the lender and borrower

- The amount of money being borrowed and what, if any, collateral is being used

- How often payments will be made in and in what amount

- Interest to be paid on the loan amount

- Penalties for late payments;

- A penalty for paying off early or statement borrower can payoff at anytime without penalty.

- Signatures of the borrower, in order for the note to be enforceable

- The collateral referenced above is property that the lender can seize if the note is not repaid; for example, when you buy a home, the house is the collateral on the mortgage.

Promissory Notes are simple straightforward documents but it is always important to review the terms to ensure they are what you agreed to when negotiating the loan.

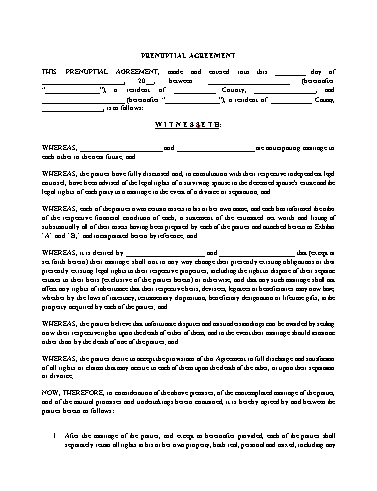

Loan Agreement

A Loan Agreement, like a Promissory Note, is a binding contract between two or more parties to formalize a loan process. There are many types of loan agreements, ranging from simple promissory notes between friends and family members to more detailed contracts like mortgages, auto loans, credit card and short- or long-term loans. Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action. In case of default, terms of collection of the outstanding debt should clearly specify the costs involved in collecting the debt. This also applies to parties using promissory notes as well. Here are key terms you should review before signing a loan agreement:

- Use of Proceeds. Most loan contracts define clearly how the proceeds will be used. There is no distinction made in law as to the type of loan made for a new home, a car, how to pay off new or old debt, or how binding the terms are. The signed loan contract is proof that the borrower and the lender have a commitment that funds will be used for a specified purpose, how the loan will be paid back

- Choice of Law: This term refers to the difference between laws in two or more jurisdictions. For example, the laws governing a specific part of a loan agreement in one state may differ from the same law in another state. It is important to identify which state (or jurisdiction’s) laws will apply. This term is also known as a “Conflict of Law.”

- Involved Parties: This refers to personal information about the borrower and lender that should be clearly stated in the loan agreement. That information should include the names, addresses, social security numbers and phone numbers for both sides.

- Severability Clause: This term states that terms of a contract are independent of each other. Thus, if one condition of the contract is deemed unenforceable by a court, that doesn’t mean all conditions are unenforceable.

- Covenants, Events of Default & Related Documents: The main difference with a Loan Agreement is that the Borrower will provide assurances to the Lender regarding its financial affairs, pending lawsuits and other matters that may effect the borrower’s ability to repay the loan in the future. If the borrower situation changes and fails to notify the Lender, they could trigger an event of default allowing the lender to claim the full amount of the loan due. In addition, the loan agreement may require the borrower to additional documents to secure the loan and guaranty payment. Examples of such documents area promissory note, security agreement, mortgage or a personal Guaranty.

Guaranty

A personal guaranty is an agreement stating that in the event that a loan made to a business is unable to make payments, that an individual will become responsible for the loan payments and entire loan balance. It’s quite rare that a personal guaranty is enacted, but it is put into place to protect the Lender in the event the event of a payment default by the borrower. A personal guaranty is a very straightforward agreement that becomes effective upon the borrower being unable to make payments or defaults in some way under any related loan document.

Your Signing experience is worth celebrating!

ApproveMe is easy document signing for busy people. Built on the belief that every new agreement with a customer or client should be celebrated.

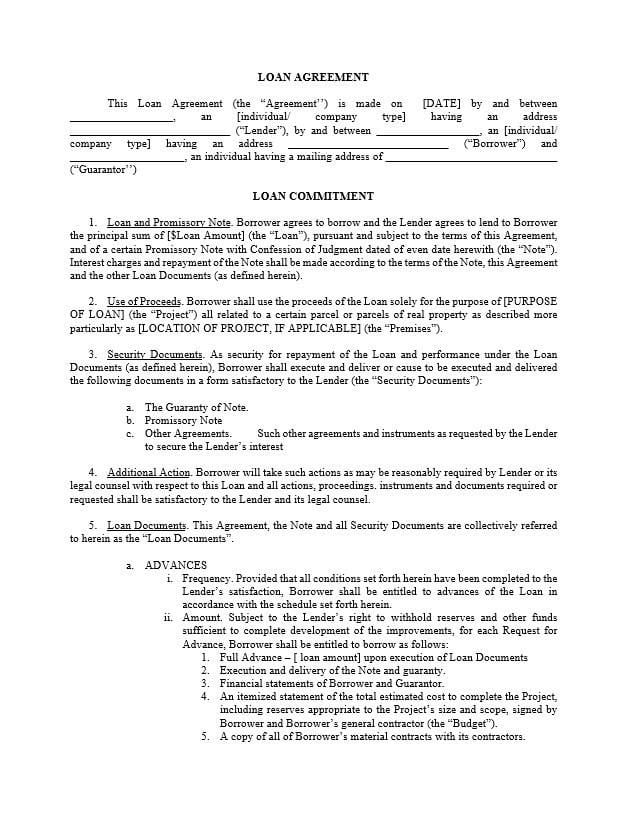

Loan Agreement

This Loan Agreement (the “Agreement’’) is made on [DATE] by and between __________________, an [individual/ company type] having an address ____________________________ (“Lender”), by and between __________________, an [individual/ company type] having an address ____________________________ (“Borrower”) and ____________________, an individual having a mailing address of ______________________________ (“Guarantor’’) LOAN COMMITMENT 1. Loan and Promissory Note. Borrower agrees to borrow and the Lender agrees to lend to Borrower the principal sum of [$Loan Amount] (the “Loan”), pursuant and subject to the terms of this Agreement, and of a certain Promissory Note with Confession of Judgment dated of even date herewith (the “Note”). Interest charges and repayment of the Note shall be made according to the terms of the Note, this Agreement and the other Loan Documents (as defined herein). 2. Use of Proceeds. Borrower shall use the proceeds of the Loan solely for the purpose of [PURPOSE OF LOAN] (the “Project”) all related to a certain parcel or parcels of real property as described more particularly as [LOCATION OF PROJECT, IF APPLICABLE] (the “Premises”). 3. Security Documents. As security for repayment of the Loan and performance under the Loan Documents (as defined herein), Borrower shall execute and deliver or cause to be executed and delivered the following documents in a form satisfactory to the Lender (the “Security Documents”): a. The Guaranty of Note. b. Promissory Note c. Other Agreements. Such other agreements and instruments as requested by the Lender to secure the Lender’s interest 4. Additional Action. Borrower will take such actions as may be reasonably required by Lender or its legal counsel with respect to this Loan and all actions, proceedings. instruments and documents required or requested shall be satisfactory to the Lender and its legal counsel. 5. Loan Documents. This Agreement, the Note and all Security Documents are collectively referred to herein as the “Loan Documents”. a. ADVANCES i. Frequency. Provided that all conditions set forth herein have been completed to the Lender’s satisfaction, Borrower shall be entitled to advances of the Loan in accordance with the schedule set forth herein. ii. Amount. Subject to the Lender’s right to withhold reserves and other funds sufficient to complete development of the improvements, for each Request for Advance, Borrower shall be entitled to borrow as follows: 1. Full Advance – [ loan amount] upon execution of Loan Documents 2. Execution and delivery of the Note and guaranty. 3. Financial statements of Borrower and Guarantor. 4. An itemized statement of the total estimated cost to complete the Project, including reserves appropriate to the Project’s size and scope, signed by Borrower and Borrower’s general contractor (the “Budget”). 5. A copy of all of Borrower’s material contracts with its contractors. 6. Evidence that all permits and other authorizations necessary to construct the Project have been obtained and evidence that the Project will comply with all federal, state and local laws, regulations, zoning, building codes and other ordinances and restrictions affecting construction and use of the Project. 7. Certified copies of the Borrower’s Articles of Organization, Operating Agreement, Full Force and Effect Certificate and Resolution(s) of Authority approving the transactions contemplated by this Agreement. 8. Conditions to Final Advance. The obligation of the Lender to make the final advance of the Loan, if any, is subject to the following: 9. An affidavit satisfactory to the Lender signed by the general contractor stating that the general contractor has received payment of all sums owing to it by Borrower in connection with it work on the Project. 10. Confirmation by Borrower satisfactory to Lender as to the status of completion of the Project and an update Budgets demonstrating the availability of sufficient funds to complete the same. 11. Waivers. Any of the conditions set forth in Sections 2.3 through 2.4 above may be waived by the Lender in whole or in part at any time without loss of the right to assert any such condition or conditions at a later time and any such waiver shall not release Borrower from any other provision of this Agreement. 12. Direct Payments. Borrower hereby grants to the Lender the right to make payments directly to the contractor. subcontractors, suppliers, and laborers on the Project. 6. Effect of Agreement. The execution of any of the Loan Documents and/or the consummation of the transactions contemplated in the Loan Documents will not constitute a violation of, be in conflict with, or constitute a default under, or, with the passage of time or delivery of notice or both, would constitute a default under, any term or provision of any agreement, contract, lease or instrument to which Borrower is a party or by which Borrower is bound. 7. Financial Condition. The financial statements of Borrower previously or hereafter delivered to the Lender fairly present the financial condition of Borrower as of the statement dates in accordance with generally accepted accounting principles, and there has been no material adverse change in Borrower’s financial condition since the date of the most recent statements furnished the Lender. 8. Litigation. There are no actions. suits, investigations, or proceedings pending against Borrowers or to the knowledge of Borrower. threatened against Borrower, or the Premises, nor are the Borrower or the Premises, subject to any order, writ, injunction or decree which has not been disclosed by the Borrower or its members to the Lender. Neither the Borrower, nor the Premises have received notice of any citations or notice of violations of any federal, state or local laws, ordinances, regulations, rules, orders of any agency or departmental guidelines. 9. Use of Proceeds. Borrower will use the loan proceeds solely for the purpose set forth herein. 10. Survival. All representations and warranties of the Borrower contained herein shall survive the execution of this Agreement and all loan advances made under this Agreement. COVENANTS 11. Covenants. Until the Note has been repaid in full. Borrower agrees as follows: a. Fees. At the time of disbursement of the loan advance and promptly upon receipt of invoices from Lender, Borrower will pay or has paid to Lender all fees or other expenses associated with or related to Borrower’s application for, making and administration of the Loan. including, without limitation, the fees and expenses of Lender’s legal counsel, title examination, title insurance policy and title commitment, survey, appraisals, environmental studies. if any, inspections, architects and engineers, brokerage fees and all other fees, costs and expenses required by Lender to satisfy the conditions of the Loan Documents. b. Permits. Borrower will furnish Lender, promptly upon executing this Agreement and upon issuance, with true copies of all licenses, approvals, certificates, and permits required or issued by all applicable governmental authorities and necessary for the lawful use, operation and development of the Premises. Borrower will, contemporaneously with signing this Agreement, collaterally assign to Lender all licenses and permits issued or to be issued in connection with use and development of the Premises and any portion thereof. c. Compliance of Laws. Borrower will comply with all applicable federal, state and local laws, ordinances, regulations, requirements, rules, orders, agency and department guidelines now existing or hereafter enacted or promulgated and any judicial or administrative interpretations, including, without limitation, zoning laws and those with regard to underground storage tanks, and the storage, disposal or treatment, transportation of Hazardous Materials. d. Promptly after receipt, Borrower will furnish to Lender a copy of any notice Borrower receives from any governmental authority. person, or entity that any litigation or proceeding pertaining to any environmental, health or safety matter has been filed or is threatened against Borrower, the Premises or Borrower or Guarantor. e. Borrower will not allow the release or disposal of any Hazardous Material on, under, or to the Premises, excluding Hazardous Materials used in the ordinary course of the business of Borrower and its tenants, and provided such release or disposal is in accordance with all applicable federal, state, and local laws, ordinances, regulations, orders, rules and agency guidelines. f. As used in this paragraph, “litigation or proceeding” means any demand, claim, notice, suit, suit in equity, action, administrative action, investigation or inquiry, whether brought by any governmental authority, private person or entity or otherwise. g. Records. Borrower will (i) at all times maintain true and complete records of books of account and, without limiting the generality of the foregoing, maintain appropriate reserves for possible losses and liabilities, all in accordance with generally accepted accounting principles consistently applied and (ii) upon prior notice, at all reasonable times, permit Lender to examine Borrower’s books and records and, at Lender’s sole expense, to make excerpts from and transcripts of such records or books of account. 12. Financial Statement. a. Borrower and Guarantor must furnish to Lender, unless otherwise requested by Lender: (i) within one hundred twenty (120) days after the end of each calendar year, complete annual financial statements of Borrower in a form and detail satisfactory to Lender; (ii) within 10 days of the filing of the same their/its signed federal tax return; and (iii) within a reasonable time after Lender’s request, all other financial information about any financial condition, operations, and property as Lender may from time to time reasonably request. b. All information and statements required by this Section 4.5 will be (i) submitted in the form and detail satisfactory to the Lender, and (ii) signed by the individual submitting the information or statement and by a financial officer of any submitter which is an entity. 13. Insurance. Borrower will obtain, pay for, provide, and maintain appropriate insurance and public liability insurance and hazard insurance, including fire coverage, insuring the Project in an amount acceptable to Lender. All insurance policies will contain loss payable endorsements satisfactory to Lender including naming Lender as an additional insured on the public liability insurance. The amount of insurance on the Premises will be at replacement cost or the maximum insurable value of Premises and all property respectively. The hazard insurance coverage, and the insurance company issuing same must be satisfactory to Lender. Borrower will furnish evidence of required insurance as Lender requests. Each insurance policy must provide that Lender is to receive notice at least ten (10) days prior to cancellation, nonrenewal, reduction of coverage or material change in policy terms. Any such insurance shall name the Lender as mortgagee or the loss payee and shall contain mortgagee and loss payee clauses as acceptable to Lender. 14. No Debts. Without Lender’s prior written consent, the Borrower may not: (i) create, incur or permit or suffer to exist any indebtedness for borrowed money or any indebtedness, except for loans from Lender in excess of One Hundred and Twenty-Five Thousand and no/100 Dollars ($125,000.00), (ii) suffer or permit the Premises any other property, real or personal, tangible or intangible, now owned or hereafter acquired by it to be or become encumbered by any mortgage, security interest, financing statement or a lien of any kind or nature, except for those in favor of Lender, or as permitted hereunder. 15. Taxes. The Borrower must timely file all required federal, state and local tax returns and timely pay all federal, state and local taxes owed of whatever kind or nature. 16. No Guarantees. Except with respect to Lender, the Borrower will not guarantee or otherwise become a surety in respect to the obligation of or lend his credit to any other person, firm, corporation, partnership, limited liability company, business enterprise, or entity. 17. Asset Dispositions. Borrower will not assign, sell or otherwise dispose of any accounts, notes receivable, trade acceptances, or except in the ordinary course of business, any other assets. 18. Additional Matters. The Borrower will comply with such other conditions as may be reasonably imposed by Lender, from time to time, which are not inconsistent with provisions of the Loan Documents. The Borrower will execute and deliver to Lender any additional documents or instruments reasonably required by Lender. DEFAULTS AND REMEDIES 19. Events of Default. The following shall constitute “Events of Default” under this Agreement: a. Failure to Perform. Borrower or Guarantor or any one of them breach or default in the performance of any term, condition or covenant, contained in this Agreement or any other Loan Document (excluding payment of principal and interest and other obligations under the Loan Document) and fail to cure such breach or default within thirty (30) days after written notice of such breach by Lender. b. Misrepresentation. Any statement, representation or information made or furnished by or on behalf of Borrower or Guarantor to the Lender in connection with or to induce the Lender to make the Loan shall prove to be false or materially misleading when made or furnished, or any warranty or representation made by Borrower in any of the Loan Documents are or prove to be untrue in any material respect. c. Nonpayment: Default in Other Documents. Borrower or Guarantor fails to pay any principal or interest under the Note, or any other sum to be paid under any provisions of the Note or any other of the Loan Documents or any document hereafter given in connection with the transactions contemplated by this Agreement, within five (5) days after the date such payment is due. d. Liens. The recording of any lien against the Project or any personal property of Borrower or Guarantor, except as permitted by the Lender and the Borrower has not removed the lien or bonded off the lien within thirty (30) days of the filing of such lien. e. Insolvency. Etc.-:- The insolvency of the Borrower or Guarantor or the admission in writing of Borrower’s inability to pay debts as they mature; or the institution of Bankruptcy, reorganization, arrangement, insolvency or other similar proceedings by or against Borrower; or the issuance or filing of any attachment, levy, garnishment or the commencement of any related proceeding or the commencement of any other judicial process upon or in respect to Borrower or the Premises and same is not dismissed within thirty (30) days of filing of same. f. Permits and Licenses. Borrower fails to keep all certificates, licenses and permits necessary for occupancy and use of the Premises and the operation of the Project in full force and effect. g. Dissolution or Liquidation of Borrower. Dissolution or liquidation of Borrower or Borrower ceases to do business. h. Abandonment. Borrower abandons the Premises or any part thereof; i. Event of Default Under Other Loan Documents. An Event of Default under any of the Loan Documents; j. Sale or Transfer of the Premises. The sale, transfer, or other disposition by Borrower of the Project, or any part thereof, or any interest therein, without the express written consent of Lender; or k. Lease. The occurrence of an event of default under the Lease of the Premises and the failure to cure the same within any notice and opportunity to cure period. l. Remedies. Upon occurrence of an Event of Default, the Lender, at its option, may exercise any or all of the following rights and remedies: m. Termination of Advances. The Lender may terminate its obligations to make advances under this Agreement. n. Acceleration. The Lender may declare all sums owed by Borrower to the Lender under this Agreement, the Note, or any other of the Loan Documents to be immediately due and payable without further notice to or demand on Borrower. o. Advance Funds. The Lender may advance funds under this Agreement to pay: (i) the costs and expenses of performing the Borrower’s obligations under this Agreement or any of the Loan Documents or curing a default by Borrower; (ii) claims or liens with priority over any interest of the Lender under any of the Loan Documents; and (iii) any cost to protect the Project from hazards, damage, vandalism, waste, weather or other risks. p. Other Remedies. The Lender may exercise all remedies specified in the Note, and the other Loan Documents, or any other documents or instruments executed by Borrower for the benefit of the Lender and may avail itself of any other remedies available to it at law or in equity. q. Attorneys’ Fees and Costs. Borrower agrees to pay and to save harmless and indemnify Lender against any reasonable attorneys’ fees, expenses and court costs incurred by the Lender in the enforcement of this Agreement. INDEMNIFICATION 20. Indemnification. The Borrower agrees to indemnify, defend and save harmless Lender, its employees, agents, successors and assigns (collectively “lndemnitees”) from and against any and all liabilities, penalties, fines, forfeitures, demands, damages, losses, claims, causes of action, suits, judgments and costs and expenses incident thereto (including costs of defense, settlement, reasonable attorneys’ fees, reasonable consultants’ fees and reasonable expert fees), which Lender or any or all of the lndemnitees may hereafter suffer, incur, be responsible for or disburse as a result of (i) the presence or release of Hazardous Materials on, under or above the Premises; (ii) any governmental action, order, directive, administrative proceeding or ruling; (iii) personal or bodily injury (including death) or damage (including loss of use) to any real or personal property (public or private); (iv) clean up, remediation, investigation or monitoring of any pollution or contamination of or adverse affects on human health or environment; (v) the use of the Premises or any portion thereafter the date of the Agreement for storage, treatment, generation, processing, handling or production of Hazardous Materials, or (vi) any violation or alleged violation of any federal, state or local laws, ordinances, orders, rules, regulations, or guidelines of any governmental entity or agency, directly or indirectly arising out of ownership and operation of the Premises; or (vii) any Event of Default under this Agreement or any other of the Loan Documents. This indemnification provision will survive payment of the Loan, and delivery of and cancellation of the Mortgage and of the Note and other Loan Documents. MISCELLANEOUS 21. Notices. All notices or demands by either party upon the other shall be in writing and shall be personally served or mailed overnight courier service or by registered or certified mail, return receipt requested, postage prepaid to the addresses set forth at the beginning of this Agreement or to such other address as either party may hereafter furnish to the other. Notices shall be deemed given upon personal delivery or as of the second business day after deposit in the United States mail. 22. Benefit and Assignment. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. Neither Borrower, nor Guarantor may assign any of its rights or duties under this Agreement without the prior written consent of the Lender. The Lender may sell, assign, transfer or convey, all or any portion of the Loan by participation or otheiwise, without notice to Borrower or Guarantor. 23. Entire Agreement and Amendment. This writing, the Note, and the Security Documents contain the entire agreement between the parties with respect to the matters described herein and are a complete and exclusive statement as to the terms thereof and supersede all previous agreements. The rights and remedies of the Lender, and the duties and obligations of Borrower and Guarantor, under all such documents shall be cumulative. In entering into this Agreement, neither Borrower nor Guarantor are relying on any oral promise or representation from the Lender or any person purporting to represent the Lender in respect of any aspect of this Agreement or the Loan. This Agreement may not be altered or modified except by a writing signed by the party against whom such alteration or modification is sought. 24. Invalidity. The invalidity of any provision of this Agreement shall not affect the validity of the remainder of any such provision or the remaining provisions of this Agreement. 25. Interpretation. The paragraph headings included in this Agreement have been used solely for convenience and shall not be used in conjunction with the interpretation of this Agreement. 26. Waiver. The failure of the Lender at any time to require performance of Borrower under any provision of this Agreement, the Note, or the Security Documents shall not be deemed a continuing waiver of that provision or a waiver of any other provision of such documents, and shall in no way affect the full right to require full performance from Borrower at any time thereafter. 27. Counterparts. This Agreement may be executed in any number of counterparts, all of which shall constitute a single agreement. 28. No Liability to Third Parties. This Agreement shall not be construed to make the Lender liable to, or to create any contractual relationship with, suppliers, contractors, craftsmen, laborers or others for labor, materials, supplies and/or services delivered by such parties, or for debts or claims accruing to such parties against the Borrower. 29. Business Days. Whenever any payment to be made under any Loan Document is required to be made on a Saturday, Sunday, or legal holiday, the payment may be made on the next succeeding business day which is not a Saturday, Sunday or legal holiday. The extension of time will be included in the computation of interest payable on the Notes. Jury Trial. BORROWER AND LENDER EACH WAIVE ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE, WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE, BETWEEN LENDER AND THE BORROWER, ARISING OUT OF, IN CONNECTION WITH, RELATED TO, OR INCIDENTAL TO THE RELATIONSHIP ESTABLISHED BETWEEN THEM IN CONNECTION WITH THIS AGREEMENT OR ANY OF THE OTHER LOAN DOCUMENTS OR THE TRANSACTION RELATED THERETO. BORROWER CONSENTS AND SUBJECTS ITSELF TO THE JURISDICTION OF THE FEDERAL AND STATE COURTS LOCATED WITHIN THE STATE OF [STATE]. Survival. The warranties, representations, covenants, and indemnification’s of the Borrower in this Agreement will survive the loan advances, the execution and delivery of the Loan Agreement, execution, delivery, and recording of the Mortgage. The warranties, representations and covenants will speak as of the date of this Agreement, the date of each and every loan advance, and will be true and accurate at all times during the term of the Loan. IN WITNESS WHEREOF, the parties have executed this Agreement on the day and year first set forth above. BORROWER: ___________________________ [BORROWER NAME] GUARANTOR: ___________________________ [GUARANTOR NAME]

Send Contracts in Minutes

Unlock the power of WP E-Signature on your website using your branding today!

Get Started Now