Operating Agreement Template

An operating agreement is an essential document used by Limited Liability Companies (LLCs). An operating agreement establishes the framework for a company’s structure covering its financial and functional decisions. What is in the Operating Agreement Template?

- An operating agreement is used as a formality to detail how a company will operate.

- An operating agreement sets the terms and details of a company’s management and ownership.

- This comprehensive operating agreement template includes the basics of a standard limited liability company (LLC) operating agreement providing you with the flexibility to customize it to your particular needs

- An operating agreement is a vital document that explains the company’s functional and financial decisions.

Top 3 Reasons Why you Need an Operating Agreement An operating agreement simply spells out how a company will, as the name suggests, operate. An operating agreement is vital for the following reasons:

- Preserve Limited Liability Status – Operating agreements shield members from personal liability. If a company lacks an operating agreement, it could be confused with a partnership or sole proprietorship, which could open the door to personal liability.

- Clarity – An operating agreement also memorializes verbal agreements. Oral agreements are messy and hard to prove, so it is always a good business practice to incorporate all verbal agreements in writing to avoid misunderstandings.

- Protection from Default State Rules – States have “default” rules that govern LLCs. If an LLC does not have an operating agreement in place, it may be subject to the state’s default rules, which are generally very broad.

Additionally, while some states, like California, may not require LLCs to formally file an operating agreement, LLCs are still required to have one in place for the company’s records. An operating agreement is a formality and one that should not be overlooked. It is critical to contact an attorney when drafting an operating agreement. Some states require a company to have an operating agreement. It all depends on which state the LLC was formed. What Should be Covered in an Operating Agreement? Operating agreements can be anywhere from three pages long to over 20 pages long. It depends on the company and if it is a single-member LLC or multi-member LLC.

- Date of formation – This can be found on the Articles of Organization complete when the LLC was formed.

- LLC Member name(s) and address(es)

- Principal place of business

- Registered agent’s name and mailing address

- Initial contributions

- Indemnification provision

- Duties, powers, and responsibilities of members

- Member(s) capital contribution, ownership percentage, and ownership interest.

- Member(s) Valuation

- Voting rights and obligations

- Allocation of profit, losses, and distribution

- Accounting policies and procedures

- Transfer of membership interests

- Dissolution and winding-up procedures

Depending on the type of LLC, whether single-member or multi-member, it is crucial to make sure you have covered all of your bases. Are you a single-member LLC? Check out our Single-Member LLC Operating Agreement here! Common Mistakes to Avoid when Drafting an Operating Agreement Drafting an operating agreement can seem like a daunting task. However, creating an operating agreement helps organize the structure of the business. It is helpful to run through the agreement and detail the specifics as it relates to your LLC. A few common mistakes include:

- Incorrectly identifying the company’s legal registered name

- Inaccurate Information /misidentifying the members

- Failing to reach out to an attorney to obtain legal advice

Each state has different rules and requirements when it comes to LLCs and operating agreements. It is critical to consult with an attorney to discuss your operating agreement. Electronic Signatures Expedite the Signature Process Electronic signatures are legally binding and accelerate the signature process. We know you have a company to run, and we are here to help you get the ball rolling. Once you have created your LLC operating agreement, it is time to secure signatures. ApproveMe.com helps get your business documents signed expeditiously so you can move on to your next task. ApproveMe has a healthy template bank to cater to your company’s needs. Check out more templates here! Key Resources for your Growing Business Where do you start? Forming your own business can seem burdensome, but it does not have to be. Check out a few of these vital resources to help you put your best foot forward:

- Small Business Administration (SBA) – Tips on choosing a business structure

- NOLO – A 50-state guide to forming an LLC

- Inc.

Your Signing experience is worth celebrating!

ApproveMe is easy document signing for busy people. Built on the belief that every new agreement with a customer or client should be celebrated.

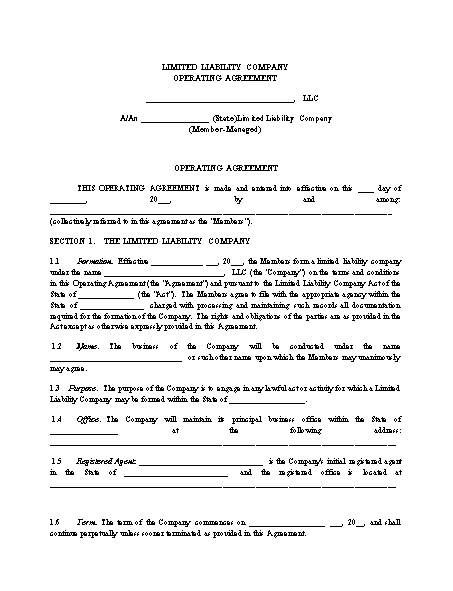

LIMITED LIABILITY COMPANY

OPERATING AGREEMENT

_____________________________________, LLC A/An _________________ (State)Limited Liability Company (Member‑Managed) OPERATING AGREEMENT THIS OPERATING AGREEMENT is made and entered into effective on this ____ day of _________, 20___, by and among: ____________________________________________________________________________________ (collectively referred to in this agreement as the “Members”). SECTION 1. THE LIMITED LIABILITY COMPANY 1.1 Formation. Effective _____________ ___, 20___, the Members form a limited liability company under the name ______________________________, LLC (the “Company”) on the terms and conditions in this Operating Agreement (the “Agreement”) and pursuant to the Limited Liability Company Act of the State of ______________ (the “Act”). The Members agree to file with the appropriate agency within the State of ________________ charged with processing and maintaining such records all documentation required for the formation of the Company. The rights and obligations of the parties are as provided in the Act except as otherwise expressly provided in this Agreement. 1.2 Name. The business of the Company will be conducted under the name _________________________________ or such other name upon which the Members may unanimously may agree. 1.3 Purpose. The purpose of the Company is to engage in any lawful act or activity for which a Limited Liability Company may be formed within the State of ___________________. 1.4 Office. The Company will maintain its principal business office within the State of _________________ at the following address: _____________________________________________________________________________________ 1.5 Registered Agent. _______________________________ is the Company’s initial registered agent in the State of __________________________ and the registered office is located at _____________________________________________________________________________________ 1.6 Term. The term of the Company commences on ___________________ ___, 20__, and shall continue perpetually unless sooner terminated as provided in this Agreement. 1.7 Names and Addresses of Members. The Members’ names and addresses are attached as Schedule 1 to this Agreement. 1.8 Admission of Additional Members. Except as otherwise expressly provided in this Agreement, no additional members may be admitted to the Company through issuance by the company of a new interest in the Company without the prior unanimous written consent of the Members. SECTION 2. CAPITAL CONTRIBUTIONS 2.1 Initial Contributions. The Members initially shall contribute to the Company capital as described in Schedule 2 attached to this Agreement. 2.2 Additional Contributions. No Member shall be obligated to make any additional contribution to the Company’s capital without the prior unanimous written consent of the Members. 2.3 No Interest on Capital Contributions. Members are not entitled to interest or other compensation for or on account of their capital contributions to the Company except to the extent, if any, expressly provided in this Agreement. SECTION 3. ALLOCATION OF PROFITS AND LOSSES; DISTRIBUTIONS 3.1 Profits/Losses. For financial accounting and tax purposes, the Company’s net profits or net losses shall be determined on an annual basis and shall be allocated to the Members in proportion to each Member’s relative capital interest in the Company as set forth in Schedule 2 as amended from time to time in accordance with U.S. Department of the Treasury Regulation 1.704-1. 3.2 Distributions. The Members shall determine and distribute available funds as they see fit. Available funds, as referred to herein, shall mean the net cash of the Company available after appropriate provision for expenses and liabilities, as determined by the Managers. Distributions in liquidation of the Company or in liquidation of a Member’s interest shall be made in accordance with the positive capital account balances pursuant to U.S. Department of the Treasury Regulation 1.704.1(b)(2)(ii)(b)(2). To the extent a Member shall have a negative capital account balance, there shall be a qualified income offset, as set forth in U.S. Department of the Treasury Regulation 1.704.1(b)(2)(ii)(d). 3.3 No Right to Demand Return of Capital. No Member has any right to any return of capital or other distribution except as expressly provided in this Agreement. No Member has any drawing account in the Company. SECTION 4. INDEMNIFICATION The Company shall indemnify any person who was or is a party defendant or is threatened to be made a party defendant, pending or completed action, suit or proceeding, whether civil, criminal, administrative, or investigative (other than an action by or in the right of the Company) by reason of the fact that he is or was a Member of the Company, Manager, employee or agent of the Company, or is or was serving at the request of the Company, against expenses (including attorney’s fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding if the Members determine that he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interest of the Company, and with respect to any criminal action proceeding, has no reasonable cause to believe his/her conduct was unlawful. The termination of any action, suit, or proceeding by judgment, order, settlement, conviction, or upon a plea of “Nolo Contendere” or its equivalent, shall not in itself create a presumption that the person did or did not act in good faith and in a manner which he reasonably believed to be in the best interest of the Company, and, with respect to any criminal action or proceeding, had reasonable cause to believe that his/her conduct was lawful SECTION 5. POWERS AND DUTIES OF MANAGERS 5.1 Management of Company. 5.1.1 The Members, within the authority granted by the Act and the terms of this Agreement shall have the complete power and authority to manage and operate the Company and make all decisions affecting its business and affairs. 5.1.2 Except as otherwise provided in this Agreement, all decisions and documents relating to the management and operation of the Company shall be made and executed by a Majority in Interest of the Members. 5.1.3 Third parties dealing with the Company shall be entitled to rely conclusively upon the power and authority of a Majority in Interest of the Members to manage and operate the business and affairs of the Company. 5.2 Election of Officers 5.2.1 The Members may elect to delegate amongst themselves the responsibilities associated with the positions of president, vice president, secretary and treasurer. Any two or more offices may be held by the same person. 5.2.2 President (Optional). The president shall be the principal executive officer of the corporation shall in general supervise and control all of the business and affairs of the corporation. He may sign, with the secretary or any other proper officer of the corporation all deeds, mortgages, bonds, contracts, or other instruments which the Members have authorized to be executed. 5.2.3 The Vice-President (Optional). In the absence of the president or in the event of his death, inability or refusal to act, the vice-president (or in the event there be more than one vice-president, the vice-presidents in the order designated at the time of their election, or in the absence of any designation, then in the order of their election) shall perform the duties of the president, and when so acting, shall have all the powers of and be subject to all the restrictions upon the president. Any vice-president may sign, with the secretary or any other proper officer of the corporation thereunto authorized by the Members, certificates for shares of the corporation; and shall perform such other duties as from time to time may be assigned to him by the president or Members. 5.2.4 The Secretary (Optional). The secretary shall: (a) keep the minutes of the proceedings of the Members and in one or more books provided for that purpose; (b) we that all notices are duly given in accordance with the provisions of this Operating Agreement or as required by law; (c) be custodian of the corporate records and of the seal of the corporation and see that the seal of the corporation is affixed to all documents the execution of which on behalf of the corporation under its seal is duly authorized; (d) keep a register of the post office address of each Member which shall be furnished to the secretary by such Member; (e) sign with the president, any vice-president, or the treasurer, certificates for shares of the corporation, the issuance of which shall have been authorized by resolution of the Members; (f) have general charge of the stock transfer books of the corporation; and (g) in general perform all duties incident to the office of secretary and such other duties as from time to time may be assigned to him by the president or by the Members. 5.2.5. The Treasurer (Optional). The treasurer shall: (a) have charge and custody of and be responsible for all funds and securities of the corporation; (b) receive and give receipts for moneys due and payable to the corporation from any source whatsoever, and deposit all such moneys in the name of the corporation in such banks, trust companies or other depositories; and (c) in general perform all of the duties incident to the office of treasurer and such other duties as from time to time may be assigned to him by the president or by the Members. The treasurer may sign, with the secretary or any other proper officer of the corporation thereunto authorized by the Members, certificates for shares of the corporation. If required by the Members, the treasurer shall give a bond for the faithful discharge of his duties in such sum and with such surety or sureties as the Members shall determine. 5.2.6. Assistant Secretaries and Assistant Treasurers (Optional). The assistant secretaries or assistant treasurers, when authorized by the president or Members, may sign with the president, any vice-president or the treasurer, certificates for shares of the corporation the issuance of which shall have been authorized by a resolution of the Members. The assistant treasurers shall respectively, if required by the Members, give bonds for the faithful discharge of their duties in such sums and with such sureties as the Members shall determine. The assistant secretaries and assistant treasurers, in general, shall perform such duties as shall be assigned to them by the secretary or the treasurer, respectively, or by the president or the Members. 5.3 Decisions by Members. Whenever in this Agreement reference is made to the decision, consent, approval, judgment, or action of the Members, unless otherwise expressly provided in this Agreement, such decision, consent, approval, judgment, or action shall mean a Majority of the Members, unless such authority is conferred to a specific officer by prior unanimous vote of the Members. 5.4 Withdrawal by a Member. A Member has no power to withdraw from the Company, except as otherwise provided in Section 8. SECTION 6. SALARIES, REIMBURSEMENT, AND PAYMENT OF EXPENSES 6.1 Organization Expenses. All expenses incurred in connection with organization of the Company will be paid by the Company. 6.2 Salary. No salary will be paid to a Member for the performance of his or her duties under this Agreement unless the salary has been approved in writing by a Majority of the Members. 6.3 Legal and Accounting Services. The Company may obtain legal and accounting services to the extent reasonably necessary for the conduct of the Company’s business. SECTION 7. BOOKS OF ACCOUNT, ACCOUNTING REPORTS, TAX RETURNS, FISCAL YEAR, BANKING 7.1 Method of Accounting. The Company will use the method of accounting previously determined by the Members for financial reporting and tax purposes. 7.2 Fiscal Year; Taxable Year. The fiscal year and the taxable year of the Company is the calendar year. 7.3 Capital Accounts. The Company will maintain a Capital Account for each Member on a cumulative basis in accordance with federal income tax accounting principles. Each member’s capital account with be determined and maintained in the manner set forth in Treasury Regulation 1.704-I(b)(2)(iv) and will consist of his or her initial capital contribution increased by: (a) Any additional capital contribution made by the Member; (b) Credit balances transferred from the Member’s distribution account to his or her capital account; and decreased by: (a) Distributions to the Member in reduction of Company capital; (b) The Member’s share of Company losses if charged to his or her capital account. 7.4 Capital Accounts and Ownership. The Members agree that changes in a Members Capital Account will not increase, decrease, or otherwise alter the ownership percentages for each Member, as stated herein. 7.5 Banking. All funds of the Company will be deposited in a separate bank account or in an account or accounts of a savings and loan association in the name of the Company as determined by a Majority of the Members. Company funds will be invested or deposited with an institution, the accounts or deposits of which are insured or guaranteed by an agency of the United States government. 7.6 Reports. The Members will close the books after the close of each calendar year, and must prepare and send to each Member a statement of that Member’s distributive share of income and expenses for income tax reporting purposes. SECTION 8. TRANSFER OF MEMBERSHIP INTEREST 8.1 Sale or Encumbrance Prohibited. Except as otherwise permitted in this Agreement, no Member may voluntarily or involuntarily transfer, sell, convey, encumber, pledge, assign, or otherwise dispose of (collectively, “Transfer”) an interest in the Company without the prior written consent of a majority of the other non-transferring Members determined on a per capita basis. 8.2 Right of First Refusal. Notwithstanding Section 8.1, a Member may transfer all or any part of the Member’s interest in the Company (the “Interest”) as follows: 8.2.1 The Member desiring to transfer his or her Interest first must provide written notice (the “Notice”) to the other Members, specifying the price and terms on which the Member is prepared to sell the Interest (the “Offer”). 8.2.2 For a period of 30 days after receipt of the Notice, the Members may acquire all, but not less than all, of the Interest at the price and under the terms specified in the Offer. If the other Members desiring to acquire the Interest cannot agree among themselves on the allocation of the Interest among them, the allocation will be proportional to the Ownership Interests of those Members desiring to acquire the Interest. 8.2.3 Closing of the sale of the Interest will occur as stated in the Offer; provided, however, that the closing will not be less than 45 days after expiration of the 30 day notice period. 8.2.4 If the other Members fail or refuse to notify the transferring Member of their desire to acquire all of the Interest proposed to be transferred within the 30 day period following receipt of the Notice, then the Members will be deemed to have waived their right to acquire the Interest on the terms described in the Offer, and the transferring Member may sell and convey the Interest consistent with the Offer to any other person or entity; provided, however, that notwithstanding anything in Section 8.2 to the contrary, should the sale to a third person be at a price or on terms that are more favorable to the purchaser than stated in the Offer, then the transferring Member must reoffer the sale of the Interest to the remaining Members at that other price or other terms; provided, further, that if the sale to a third person is not closed within six months after the expiration of the 30 day period describe above, then the provisions of Section 8.2 will again apply to the Interest proposed to be sold or conveyed. 8.2.5 Notwithstanding the foregoing provisions of Section 8.2, should the sole remaining Member be entitled to and elect to acquire all the Interests of the other Members of the Company in accordance with the provisions of Section 8.2, the acquiring Member may assign the right to acquire the Interests to a spouse, lineal descendent, or an affiliated entity if the assignment is reasonably believed to be necessary to continue the existence of the Company as a limited liability company. 8.3 Substituted Parties. Any transfer in which the Transferee becomes a fully substituted Member is not permitted unless and until: (1) The transferor and assignee execute and deliver to the Company the documents and instruments of conveyance necessary or appropriate in the opinion of counsel to the Company to effect the transfer and to confirm the agreement of the permitted assignee to be bound by the provisions of this Agreement; and; (2) The transferor furnishes to the Company an opinion of counsel, satisfactory to the Company, that the transfer will not cause the Company to terminate for federal income tax purposes or that any termination is not adverse to the Company or the other Members; unless; (3) The substituted party is an issue of the Member, or a Trust settled by the Member, in which case the substituted party becomes a fully substituted party. 8.4 Disability or Incompetency. In the event a Member is rendered disabled and is unable to contribute labor to the Company, _________ (____%) of said disabled Member’s ownership interest will automatically transfer to the other Member at the close of the fiscal year in which the disabled Member was rendered unable to contribute labor to the Company. The disabled member 8.5 Death of Member. On the death of a Member (other than a Member described in Section 8.5.1) the Member’s interest shall immediately, and for a limited time, vests in the Member’s spouse, should one exist, and if there is no spouse then the Member’s interest shall immediately vest the remaining Members. A deceased Member’s spouse will receive only the economic right to receive distributions whenever made by the Company and the Member’s allocable share of taxable income, gain, loss, deduction, and credit (the “Economic Rights”) for the fiscal year in which the deceased Member died. After which time, all of the deceased Member’s ownership interest and Economic Rights will automatically transfer to the remaining Members. 8.5.1 Death of Sole Remaining Member. Unless a beneficiary is designated in writing, on the death of the sole remaining Member, the Member’s interest shall immediately vest in the Member’s spouse, should one exist, and if there is no spouse then the Member’s interest shall immediately vest in the Member’s living children and issue of any deceased child per stirpes and in accordance with 8.3, be considered a fully substituted Member. 8.5.2 Any transfer of Economic Rights pursuant to Section 8.5, but not 8.5.1, will not include any right to participate in management of the Company, including any right to vote, consent to, and will not include any right to information on the Company or its operations or financial condition. Following any transfer of only the Economic Rights of a Member’s Interest in the Company, the transferring Member’s power and right to vote or consent to any matter submitted to the Members will be eliminated, and the Ownership Interests of the remaining Members, for purposes only of such votes, consents, and participation in management, will be proportionately increased until such time, if any, as the transferee of the Economic Rights becomes a fully substituted Member. 8.5.3 Notwithstanding the foregoing provisions of Section 8.5, should the sole remaining Member be entitled to and elect to acquire all the Interests of the other Members of the Company the acquiring Member may assign the right to acquire the Interests to a spouse, lineal descendent, or an affiliated entity if the assignment is reasonably believed to be necessary to continue the existence of the Company as a limited liability company. SECTION 9. DISSOLUTION AND WINDING UP OF THE COMPANY 9.1 Dissolution. The Company will be dissolved on the happening of any of the following events: 9.1.1 Sale, transfer, or other disposition of all or substantially all of the property of the Company; 9.1.2 The agreement of all of the Members; 9.1.3 By operation of law; or 9.1.4 The death, incompetence, expulsion, or bankruptcy of a Member, or the occurrence of any event that terminates the continued membership of a Member in the Company, unless there are then remaining at least the minimum number of Members required by law and all of the remaining Members, within 120 days after the date of the event, elect to continue the business of the Company. 9.2 Winding Up. On the dissolution of the Company (if the Company is not continued), the Members must take full account of the Company’s assets and liabilities, and the assets will be liquidated as promptly as is consistent with obtaining their fair value, and the proceeds, to the extent sufficient to pay the Company’s obligations with respect to the liquidation, will be applied and distributed, after any gain or loss realized in connection with the liquidation has been allocated in accordance with Section 3 of this Agreement, and the Members’ Capital Accounts have been adjusted to reflect the allocation and all other transactions through the date of the distribution, in the following order: 9.2.1 To payment and discharge of the expenses of liquidation and of all the Company’s debts and liabilities to persons or organizations other than Members; 9.2.2 To the payment and discharge of any Company debts and liabilities owed to Members; and 9.2.3 To Members in the amount of their respective adjusted Capital Account balances on the date of distribution; provided, however, that any then‑outstanding Default Advances (with interest and costs of collection) first must be repaid from distributions otherwise allocable to the Defaulting Member pursuant to Section 9.2.3. SECTION 10. GENERAL PROVISIONS 10.1 Amendments. Amendments to this Agreement may be proposed by any Member. A proposed amendment will be adopted and become effective as an amendment only on the written approval of all of the Members. 10.2 Governing Law. This Agreement and the rights and obligations of the parties under it are governed by and interpreted in accordance with the laws of the State of ___________________ (without regard to principles of conflicts of law). 10.3 Entire Agreement; Modification. This Agreement constitutes the entire understanding and agreement between the Members with respect to the subject matter of this Agreement. No agreements, understandings, restrictions, representations, or warranties exist between or among the members other than those in this Agreement or referred to or provided for in this Agreement. No modification or amendment of any provision of this Agreement will be binding on any Member unless in writing and signed by all the Members. 10.4 Attorney Fees. In the event of any suit or action to enforce or interpret any provision of this Agreement (or that is based on this Agreement), the prevailing party is entitled to recover, in addition to other costs, reasonable attorney fees in connection with the suit, action, or arbitration, and in any appeals. The determination of who is the prevailing party and the amount of reasonable attorney fees to be paid to the prevailing party will be decided by the court or courts, including any appellate courts, in which the matter is tried, heard, or decided. 10.5 Further Effect. The parties agree to execute other documents reasonably necessary to further effect and evidence the terms of this Agreement, as long as the terms and provisions of the other documents are fully consistent with the terms of this Agreement. 10.6 Severability. If any term or provision of this Agreement is held to be void or unenforceable, that term or provision will be severed from this Agreement, the balance of the Agreement will survive, and the balance of this Agreement will be reasonably construed to carry out the intent of the parties as evidenced by the terms of this Agreement. 10.7 Captions. The captions used in this Agreement are for the convenience of the parties only and will not be interpreted to enlarge, contract, or alter the terms and provisions of this Agreement. 10.8 Notices. All notices required to be given by this Agreement will be in writing and will be effective when actually delivered or, if mailed, when deposited as certified mail, postage prepaid, directed to the addresses first shown above for each Member or to such other address as a Member may specify by notice given in conformance with these provisions to the other Members. IN WITNESS WHEREOF, the parties to this Agreement execute this Operating Agreement as of the date and year first above written. MEMBERS: _________________________________ Printed/Typed Name _________________________________ Signature _________________________________ Printed/Typed Name _________________________________ Signature _________________________________ Printed/Typed Name _________________________________ Signature _________________________________ Printed/Typed Name _________________________________ Signature _________________________________ Printed/Typed Name _________________________________ Signature Listing of Members – Schedule 1 LIMITED LIABILITY COMPANY OPERATING AGREEMENT FOR ________________________________________________ LISTING OF MEMBERS As of the _____ day of __________, 20__ the following is a list of Members of the Company: NAME: ___________________________ ADDRESS: ___________________________ _____________________________________ NAME: ___________________________ ADDRESS: ___________________________ _____________________________________ NAME: ___________________________ ADDRESS: ___________________________ _____________________________________ NAME: ___________________________ ADDRESS: ___________________________ _____________________________________ Authorized by Member(s) to provide Member Listing as of this ____day of _________ 20__. _________________________________ Printed/Typed Name _________________________________ Signature _________________________________ Printed/Typed Name _________________________________ Signature Listing of Capital Contributions – Schedule 2 LIMITED LIABILITY COMPANY OPERATING AGREEMENT FOR __________________________________________________________ CAPITAL CONTRIBUTIONS Pursuant to ARTICLE 2, the Members’ initial contribution to the Company capital is stated below. The description and each individual portion of this initial contribution is as follows: Name Contribution % Ownership SIGNED AND AGREED this ____ day of ____________, 20___. _________________________________ Printed/Typed Name _________________________________ Signature _________________________________ Printed/Typed Name _________________________________ Signature Listing of Valuation of Members Interest – Schedule 3 LIMITED LIABILITY COMPANY OPERATING AGREEMENT FOR _________________________________________________ VALUATION OF MEMBERS INTEREST Pursuant to ARTICLE 8, the value of each Member’s interest in the Company is endorsed as follows: Name Valuation SIGNED AND AGREED this ____ day of ____________, 20___. _________________________________ Printed/Typed Name _________________________________ Signature _________________________________ Printed/Typed Name _________________________________ Signature

Send Contracts in Minutes

Unlock the power of WP E-Signature on your website using your branding today!

Get Started Now