Operating Agreement Template

An operating agreement is an essential document used by Limited Liability Companies (LLCs). An operating agreement establishes the framework for a company’s structure covering its financial and functional decisions. What is in the Operating Agreement Template?

- An operating agreement is used as a formality to detail how a company will operate.

- An operating agreement sets the terms and details of a company’s management and ownership.

- This comprehensive operating agreement template includes the basics of a standard limited liability company (LLC) operating agreement providing you with the flexibility to customize it to your particular needs

- An operating agreement is a vital document that explains the company’s functional and financial decisions.

Top 3 Reasons Why you Need an Operating Agreement An operating agreement simply spells out how a company will, as the name suggests, operate. An operating agreement is vital for the following reasons:

- Preserve Limited Liability Status – Operating agreements shield members from personal liability. If a company lacks an operating agreement, it could be confused with a partnership or sole proprietorship, which could open the door to personal liability.

- Clarity – An operating agreement also memorializes verbal agreements. Oral agreements are messy and hard to prove, so it is always a good business practice to incorporate all verbal agreements in writing to avoid misunderstandings.

- Protection from Default State Rules – States have “default” rules that govern LLCs. If an LLC does not have an operating agreement in place, it may be subject to the state’s default rules, which are generally very broad.

Additionally, while some states, like California, may not require LLCs to formally file an operating agreement, LLCs are still required to have one in place for the company’s records. An operating agreement is a formality and one that should not be overlooked. It is critical to contact an attorney when drafting an operating agreement. Some states require a company to have an operating agreement. It all depends on which state the LLC was formed. What Should be Covered in an Operating Agreement? Operating agreements can be anywhere from three pages long to over 20 pages long. It depends on the company and if it is a single-member LLC or multi-member LLC.

- Date of formation – This can be found on the Articles of Organization complete when the LLC was formed.

- LLC Member name(s) and address(es)

- Principal place of business

- Registered agent’s name and mailing address

- Initial contributions

- Indemnification provision

- Duties, powers, and responsibilities of members

- Member(s) capital contribution, ownership percentage, and ownership interest.

- Member(s) Valuation

- Voting rights and obligations

- Allocation of profit, losses, and distribution

- Accounting policies and procedures

- Transfer of membership interests

- Dissolution and winding-up procedures

Depending on the type of LLC, whether single-member or multi-member, it is crucial to make sure you have covered all of your bases. Are you a single-member LLC? Check out our Single-Member LLC Operating Agreement here ! Common Mistakes to Avoid when Drafting an Operating Agreement Drafting an operating agreement can seem like a daunting task. However, creating an operating agreement helps organize the structure of the business. It is helpful to run through the agreement and detail the specifics as it relates to your LLC. A few common mistakes include:

- Incorrectly identifying the company’s legal registered name

- Inaccurate Information /misidentifying the members

- Failing to reach out to an attorney to obtain legal advice

Each state has different rules and requirements when it comes to LLCs and operating agreements. It is critical to consult with an attorney to discuss your operating agreement. Electronic Signatures Expedite the Signature Process Electronic signatures are legally binding and accelerate the signature process. We know you have a company to run, and we are here to help you get the ball rolling. Once you have created your LLC operating agreement, it is time to secure signatures. ApproveMe.com helps get your business documents signed expeditiously so you can move on to your next task. ApproveMe has a healthy template bank to cater to your company’s needs. Check out more templates here! Key Resources for your Growing Business Where do you start? Forming your own business can seem burdensome, but it does not have to be. Check out a few of these vital resources to help you put your best foot forward:

- Small Business Administration (SBA) – Tips on choosing a business structure

- NOLO – A 50-state guide to forming an LLC

- Inc.

Your Signing experience is worth celebrating!

ApproveMe is easy document signing for busy people. Built on the belief that every new agreement with a customer or client should be celebrated.

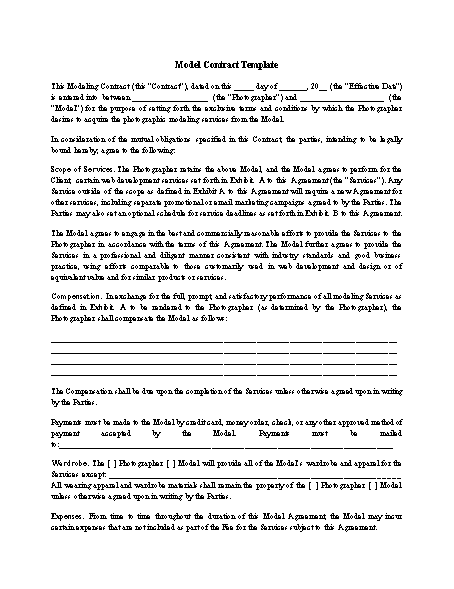

LIMITED LIABILITY COMPANY OPERATING AGREEMENT

OPERATING AGREEMENT OF ____________________________________, L.L.C. THIS OPERATING AGREEMENT is entered as of the ____ day of ____________, 20__ (the “Effective Date”), by ______________________________________, L.L.C., a limited liability company organized and existing under the laws of the State of ____________________, having its principal place of business at _____________________________________________________________________________________________(the “Company”), and _____________________________, having a residence address of _____________________________________________________________________________________________(the “Member”), as sole member. ARTICLE I. DEFINITIONS 1. Certain Definitions. As used herein, the following terms have the following meanings: (a) “Act” means the Limited Liability Company Act of the State of _______________, as from time to time amended. (b) “Agreement” means this Operating Agreement, as the same may be amended from time to time. (c) “Code” means the Internal Revenue Code of 1986, as amended from time to time. (d) “Company” means ______________________, L.L.C., the limited liability company formed and governed pursuant to this Agreement. (e) “Legal Representative” or “legal representative” of a Member shall mean executor, executors, administrator, administrators, committee, guardian, distributee, under the intestacy laws or other personal representative of a deceased Member. (f) “Person” or “person” shall mean any individual, trust, estate, partnership, association, firm, company, corporation or any state or public officer, agency or instrumentality. (g) “Property” shall mean any and all assets and property of the Company, real or personal, tangible or intangible (including but not limited to goodwill), including but not limited to money and any legal or equitable interest in any such assets and property, but excluding services and promises to perform services in the future. (h) “Transfer” or “transfer” shall mean sell, assign, convey, donate, bequeath, pledge, grant a security interest in, encumber, transfer or otherwise dispose of or contract to transfer, whether voluntarily or involuntarily. (i) “Treasury Regulation(s)” means the regulations of the United States Department of the Treasury promulgated under the Code, as amended or supplemented from time to time. 1.2. Formation of the Company. The Member agrees to form the Company under and pursuant to the provisions of the Act, for the purposes and scope set forth in the Articles of Organization and this Agreement. The Member shall cause to be filed in the appropriate governmental office Articles of Organization that conform to the requirements of the Act in order to constitute the Company as a valid limited liability company under the Act. The costs and expenses associated with its formation shall be borne by the Company. 1.3. Name. The Company’s name shall be “_________________________________ L.L.C.,” and such name shall be used at all times in connection with the business and affairs of the Company. 1.4. Name and Address of Sole Member. The name and mailing address of the Member are as set forth at the beginning of this Agreement. 1.5. Principal Office. The principal office of the Company shall be at ___________________________________________________________________________________________, or such other location as may be hereinafter determined by the Member. 1.6. Statutory Agent for Service. The Company’s statutory agent for service shall be _______________________, with a business address at _____________________________________________________________________________________________. 1.7. Election of Tax Status. Pursuant to Sections 301.7701-1 through 301.7701-3, inclusive, of the Treasury Regulations, the Company elects to be taxed as a [sole proprietorship/corporation] for federal, state and local income tax purposes. The Member shall complete and file IRS Form 8832, and any similar filing required by the State of _________________, with all appropriate governmental agencies setting forth such election. ARTICLE II. CAPITAL CONTRIBUTIONS 2.1. Initial Capital Contributions. As of the Effective Date, the Member has heretofore made his/her or its respective capital contributions to the Company as reflected on Schedule 2.1 attached hereto and incorporated herein by reference. 2.2. Additional Capital Contributions. Except as otherwise provided in Schedule 2.1, the Member shall not be required to make capital contributions in addition to those mentioned in the preceding paragraph. ARTICLE III. DISTRIBUTIONS 3.1. Distributions. Subject to the provisions of Section 7.3 hereof, the Company’s net profits shall be distributed to the Member at such times and in such amounts as the Member shall determine in his/her or its absolute discretion. Such distributions may take the form of cash or Property as the Member shall determine in his/her or its absolute discretion. ARTICLE IV. ACCOUNTING 4.1. Accounting Methods. The Company books and records shall be prepared in accordance with generally accepted accounting principles, consistently applied. The Company shall be on a [cash] or [accrual] asis for both tax and accounting purposes, or as otherwise determined by the Member. The Member is hereby designed as the “tax matters partner” for the Company (as such term is defined in Section 6231(a)(7) of the Code). 4.2. Fiscal Year. The fiscal year of the Company shall be the twelve calendar month period ending December 31. ARTICLE V. MANAGEMENT 5.1. Member’s Powers. The business, affairs and property of the Company shall be managed by the Member pursuant to the rules contained in the Act for limited liability companies in which management is not vested in managers. ARTICLE VI. TRANSFER OF MEMBER’S INTEREST 6.1. Transfer Permitted. All or a portion of the Member’s membership interest in the Company may be disposed of in any manner provided by law and, upon such disposition, the transferee shall become a Member without further action on the part of the transferee, the Company or the Member. ARTICLE VII. DISSOLUTION OF THE COMPANY; DISSOCIATION OF A MEMBER 7.1. Dissolution of the Company. (a) The Company shall dissolve upon the happening of the first to occur of the events listed in Section _____ of the Act, as amended. (b) Notwithstanding the foregoing, if an event of dissociation (as such term is defined in Section _____ of the Act, as amended), occurs at any time there is only one Member of the Company, the legal representative of such dissociating Member or the Person succeeding to the Member’s membership interest in the Company as a result of such event of dissociation may, at the election of such legal representative or other Person, become a Member without further action on the part of the transferee, the Company or the Member; provided that if such legal representative or other Person fails to become a Member within _______ (_____) days after the event of dissociation, then the Company shall be deemed dissolved for purposes of the Act and such legal representative or other Person shall take all action required by the Act to wind up the business and affairs of the Company. 7.2. Effect of Dissolution. Upon dissolution, the Company shall cease carrying on the Company business except as necessary for the winding up of the Company business, and the Company is not terminated, but rather shall continue until the winding up of the affairs of the Company is completed and a Certificate of Dissolution has been issued by the Secretary of State of the State of _______________. 7.3. Distribution of Assets on Dissolution. Upon the winding up of the Company, the Company’s Property shall be distributed: first, to creditors, including the Member if then a creditor, to the extent permitted by law, in satisfaction of the Company’s indebtedness and other liabilities; and second, to the Member, or if the Member is not then living, as otherwise directed by the Member in writing, or if the Member is not then living and no such writing exists, by the laws of intestacy of the State of _____________. Liquidation proceeds shall be paid within _____ (_____) days of the end of the Company’s taxable year or, if later, within _____ (_____) days after the date of liquidation. 7.4. Winding Up and Certificate of Dissolution. The winding up of the Company shall be completed when all debts, liabilities and obligations of the Company have been paid and discharged or reasonably adequate provision therefore has been made, and all of the remaining Property and assets of the Company have been distributed as provided in Section 8.3 hereof. Upon the completion of winding up of the Company, a Certificate of Dissolution shall be delivered to the Office of the Secretary of State of the State of _______________ for filing. The Certificate of Dissolution shall set forth the information required by the Act. ARTICLE VIII. GENERAL 8.1. General. This Agreement supersedes any prior agreement or understandings between the parties with respect to the Company. This Agreement and the rights of the parties hereunder shall be governed by and interpreted in accordance with the laws of the State of ________________. This Agreement may not be amended or modified verbally, nor may any provision hereof be waived by any party, but only by a written instrument duly executed by the Company and the Member. Except as herein otherwise specifically provided, this Agreement shall be binding upon and inure to the benefit of the parties and their respective heirs, legal representatives, successors and assigns. If any provision of this Agreement or the application of such provision to any person or circumstance shall be held invalid, the remainder provision or any other persons of circumstances, shall not be affected thereby. This Agreement may be executed in several counterparts, each of which shall be deemed an original, but all of which shall constitute one and the same document. 8.2. Entire Agreement. This Agreement represents the entire agreement between the parties relating to the subject matter hereof. 8.3. Rights of Creditors and Third Parties Under Agreement. This Agreement is entered into between the Company and the Member for the exclusive benefit of the Company, the Member and their successors and assigns. This Agreement is expressly not intended for the benefit of any creditors of the Company or any other Person. Except and only to the extent provided by applicable law, no such creditor or third party shall have any rights under this Agreement or any other agreement between the Company and the Member. IN WITNESS WHEREOF, the undersigned have executed this Agreement as of the date first above written. INITIAL MEMBER: _________________________________ Printed Name _________________________________ Signature COMPANY: _________________________________ Name of Company _________________________________ Printed Name of Signatory _________________________________ Signature SCHEDULE 2.1. CAPITAL CONTRIBUTION Name of Member Amount of Initial Contribution

Frequently Asked Questions

What is an operating agreement template?

It is important to have this document in place before starting a new business as it can help avoid disputes in the future.

What needs to be in an LLC operating agreement template?

- Company name and address

- Directors and officers of the company

- Powers of management, including powers to bind and to terminate memberships

- Purpose of company and its objects

- Governing law

- Members' ownership interest

- Restrictions on transferability

Is this single member llc operating agreement template free?

Can I create my own operating agreement template?

What should be included in an operating agreement template?

- The purpose of the company

- The duration of the company

- Who has voting rights in the board of directors

- How decisions are made and how they are carried out

Where do I get an LLC operating agreement template?

Is an operating agreement template free?

Do operating agreements need to be notarized?

In some states, operating agreements are not required to be notarized and can be signed by two people in person or by emailing a scanned copy of the agreement back and forth. It is always best to consult a lawyer or an accountant for legal advice if you aren’t sure if your operating agreement should be notarized.

How much does a lawyer charge for an operating agreement?

Do all LLC have an operating agreement?

Do I need an operating agreement to open a bank account?

The best thing to do would be to call your bank ahead of time and ask them what the requirements are. Then you can be prepared with the necessary documentation when you arrive at the bank.

Does a single member LLC need an operating agreement?

What is a LLC operating agreement template?

Who needs a Operating Agreement Template?

It lays the foundation for your business details and practices, and having a template for one helps avoid the common pitfalls such as misunderstandings about responsibilities and disputes arising from unclear agreements.

How to write a Operating Agreement Template

- The name of the company

- The location of the company

- The purpose of the company and what it will do

- The members in charge and their roles

- How long members are allowed to stay in charge for, and when they must step down

What must a business operating agreement template have?

The operating agreement also includes provisions for how disputes will be resolved and how members can be removed from the company.

Do sole member llc operating agreements have to be in writing?

What should I put in my free operating agreement template?

The operating agreement also includes provisions for how disputes will be resolved and how members can be removed from the company.

Where can I find a sample operating Agreement Template?

Then you can review the template and add your business-specific information in the bracketed sections. Once the document is to your liking, you can have it reviewed by legal counsel if you wish.

How long are operating agreement templates good for?

The length of the operating agreement template is dependent on the specifics of your business. For example, if you are in a service business, then an operating agreement template for a one-year term may be sufficient. It is important to find an operating agreement template that meets the requirements of your company.

What are some free llc operating agreement template examples?

Use the Download Contract button to access this free LLC operating agreement template example.

Send Contracts in Minutes

Unlock the power of WP E-Signature on your website using your branding today!

Get Started Now