Personal Loan Agreement Template

A personal loan agreement, or promissory note, is a legally binding contract typically entered into between family members and friends. A loan agreement details the repayment of the loan and other important terms and conditions. A written loan agreement is important because it protects the lender. The lender can rely on the terms of the agreement to enforce repayment of the loan. What is in this Personal Loan Agreement Template?

- This personal loan agreement template was created to help you customize your own personal loan agreement.

- Drafting tips on simple loan agreements

- Details on how to get your Loan Agreement signed with ApproveMe

Why do you need a Personal Loan Agreement? A personal loan agreement is needed when money is loaned. Loans are also known as “notes.” The party lending the money is referred to as the lender, and the party borrowing the money is referred to as the borrower. A written personal loan agreement protects the lender if the borrower fails to pay or if the loan goes into default. A personal loan agreement should be in writing. This is for a few reasons:

- Repayment terms are clearly defined

- Parties are legally bound by the terms in the agreement

- Protects the lender and provides a legal remedy

When lending or borrowing money from friends and family, it can be challenging to enter into a written contract because it is hard to imagine the deal will fall through. A written agreement illustrates the parties’ agreement and provides the lender with assurances if the borrower fails to repay the loan. What is a Personal Loan Agreement? A personal loan agreement lays out the terms of the loan. The agreement memorializes the borrower’s promise to repay the loan. The lender delineates the borrower’s financial obligations, and the parties agree to a payment plan. There are many types of loan agreements running from auto loans to business loans. However, personal loans are more flexible. Loans can either be secured or unsecured. Personal loan agreements are generally unsecured. However, when a loan is secured, the borrower places a piece of owned property as collateral. Therefore, if the borrower cannot make their payments or defaults, the lender takes possession and ownership of the property. For example, it may not be sufficient just to describe the collateral as “my truck” or “my green truck.” Instead, it should be listed with the year, make, and other details like “ silver Mercedes SLK 250.” The more detailed, the better to eliminate the potential of any confusion in the future. If the loan is secured, it is crucial to clearly identify and describe the property. If the borrower wants to list their truck as collateral, it should be specific and detailed. Sometimes personal loan agreements will include an interest clause. This is implemented when the lender wishes the borrower to pay a certain percentage of interest on a monthly, annual, or another agreed-upon basis. Other Names for a personal loan agreement include:

- Promissory Note

- Loan Contract

- IOU

- Simple Loan Agreement

- Personal Payment Agreement

- Installment Agreement

What Should be Included in a Personal Loan Agreement? Personal loan agreements are legally binding, so it is important to include certain elements to protect the parties to the agreement. Personal loan agreements will consist of unique clauses that may not be found in other contracts. Here are a few essential components of a simple personal loan agreement:

- Parties to the agreement (Lender/Borrower)

- Effective Date

- Loan Amount (Financial Obligation/Amount of Money)

- Payment Schedule, Installments, Payment Terms

- Payment Due Dates (monthly, weekly, etc.) and Late Fees or other Penalties

- Interest Rate (if applicable)

- Collateral/Security (if applicable)

- Dispute Resolution and Governing Law

- Contact Information for the Borrower and Lender

The loan agreement should list the total amount of the loan. It should also specify if the repayment schedule requires a monthly payment or weekly payment. Common Mistakes to Dodge when Drafting a Personal Loan Agreement A personal loan agreement should incorporate any and all terms of the parties’ agreement. Some common mistakes in personal loan agreements include:

- Leaving out the total loan amount

- Failing to incorporate an attainable and reasonable payment plan

- Omitting payment amounts, payment schedule, late payments, and late fees

- Missing all appropriate signatures

- Not reaching out to an attorney to obtain legal advice.

How to get your Personal Payment Agreement Signed Look no further, ApproveMe has your solution. ApproveMe’s WP E-Signature tool helps you obtain legally binding electronic signatures while organizing all of your documents. ApproveMe is safe and secure. Check out our reviews from our satisfied customers here! Financial Resources As a new or seasoned entrepreneur managing your finances is critical. Here are a few links to explore focused on financial organization and efficiency:

Your Signing experience is worth celebrating!

ApproveMe is easy document signing for busy people. Built on the belief that every new agreement with a customer or client should be celebrated.

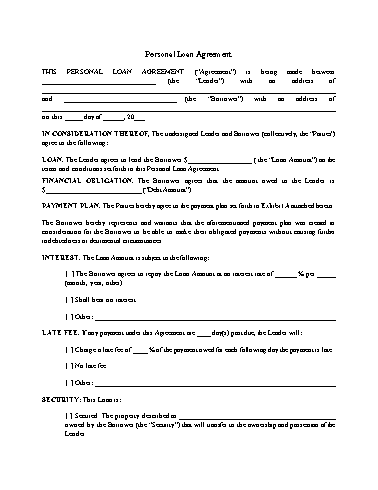

Personal Loan Agreement

THIS PERSONAL LOAN AGREEMENT (“Agreement”) is being made between ________________________________ (the “Lender”) with an address of _____________________________________________________________________________________and ________________________________ (the “Borrower”) with an address of _____________________________________________________________________________________ on this _____ day of ______, 20___. IN CONSIDERATION THEREOF, The undersigned Lender and Borrower (collectively, the “Parties”) agree to the following: LOAN. The Lender agrees to lend the Borrower $__________________ ( the “Loan Amount”) on the terms and conditions set forth in this Personal Loan Agreement. FINANCIAL OBLIGATION. The Borrower agrees that the amount owed to the Lender is $___________________________ (“Debt Amount”). PAYMENT PLAN. The Parties hereby agree to the payment plan set forth in Exhibit A attached hereto. The Borrower hereby represents and warrants that the aforementioned payment plan was created in consideration for the Borrower to be able to make their obligated payments without causing further indebtedness or detrimental circumstances. INTEREST. The Loan Amount is subject to the following: [ ] The Borrower agrees to repay the Loan Amount at an interest rate of ______ % per ______ (month, year, other). [ ] Shall bear no interest. [ ] Other: ______________________________________________________________________ LATE FEE. If any payment under this Agreement are ____ day(s) past due, the Lender will: [ ] Charge a late fee of ____ % of the payment owed for each following day the payment is late. [ ] No late fee [ ] Other: ______________________________________________________________________ SECURITY: This Loan is: [ ] Secured. The property described as ______________________________________________ owned by the Borrower (the “Security”) that will transfer to the ownership and possession of the Lender. [ ] Unsecured. There will be no Security under this Personal Loan Agreement DEFAULT. In the event that the Borrower defaults on any payments and fails to cure the default within a reasonable amount of time, the Lender will have the option to accelerate and declare the entire remaining amount of the Principal and any accrued interest to be immediately due and payable. SEVERABILITY. In the event any part or provision of this Agreement is deemed unenforceable or invalid, in part or in whole, that part shall be severed from the remainder of the Personal Loan Agreement and all other parts or provisions shall continue in full force and effect as valid and enforceable. DISPUTE RESOLUTION. Parties to this Agreement shall first attempt to settle any dispute through a good-faith negotiation. If the dispute cannot be settled between the parties via negotiation, either party may initiate mediation or binding arbitration in the State of ________________. If the parties do not wish to mediate or arbitrate the dispute and litigation is necessary, this Agreement will be interpreted based on the laws of the State of _________________, without regard to the conflict of law provisions of such state. The Parties agree the dispute will be resolved in a court of competent jurisdiction in the State of ______________________. The prevailing party to the dispute will be able to recover its attorney’s fees and other reasonable costs for a dispute resolved by litigation or binding arbitration. GOVERNING LAW AND JURISDICTION. The laws of the State of _______________ shall govern as to the interpretation, validity, and effect of this Agreement. AMENDMENT, WAIVER, OR MODIFICATION. No provisions of this Agreement shall be amended, waived or modified except by any instrument in writing signed by all the parties hereto. NO ASSIGNMENT. The Parties agree that they shall not assign or encumber their rights and obligations under this agreement. ENTIRE AGREEMENT. This Agreement constitutes the sole and entire agreement of the Parties regarding the subject matter contained herein, and supersedes all prior and contemporaneous understandings, agreements, representations, and warranties, both written and oral, regarding such subject matter. This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by each Party hereto. COUNTERPARTS. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile. email, or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement. ELECTRONIC SIGNATURES. This Agreement and related documents entered into in connection with this Agreement are signed when a party’s signature is delivered electronically, and these signatures must be treated in all respects as having the same force and effect as original signatures. MISCELLANEOUS. This Agreement cannot be changed, modified, terminated, canceled, rescinded, or in any other way altered or negated unless the same is in writing and signed by the party against whom enforcement of the change, modification, discharge, termination, cancellation, or rescission is sought. It is agreed that all understandings and agreements heretofore had between the parties are merged in this Agreement, which alone fully and completely expresses their understanding, and this Agreement has been entered into after full investigation and consideration, neither party relying upon any statement or representation, not embodied in this Agreement, which may be claimed to have been made by any of the parties hereto. IN WITNESS WHEREOF, the Borrower and the Lender have executed this Personal Loan Agreement the day and year first above written. Dated:_________________________________ ________________________________________ Lender’s Signature ________________________________________ Lender’s Printed Name Dated:_________________________________ ________________________________________ Borrower’s Signature ________________________________________ Borrower’s Printed Name Lender’s Contact Information: Address: ______________________________ ______________________________________ ______________________________________ Phone Number: _________________________ Email Address: _________________________ Borrower’s Contact Information: Address: ______________________________ ______________________________________ ______________________________________ Phone Number: _________________________ Email Address: _________________________ Exhibit A Payment Plan The parties hereby agree to the following payment plan: ____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ Other: _____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Frequently Asked Questions

What is a Personal Loan Agreement?

Personal loans are used for different purposes such as home improvement, medical bills and emergencies. There are also some loans available for education expenses such as college tuition.

How do I write a Personal Loan Agreement?

Are personal loan agreements legal?

How do I draft a friendly personal loan contract?

- Be clear about your rights as a borrower

- Keep in mind that the lender will likely have their own set of rights as well

- Make sure that your loan contract includes an interest rate, repayment schedule, penalties for late payments, etc

- Take care to use language that is clear and concise

Does a personal loan agreement need to be notarized?

What is the difference between a loan agreement and a promissory note?

A promissory note is an agreement between two parties in which one party promises to repay another party an amount of money at some point in the future. It can be written as a check or as an IOU with some bank or financial institution.

how to write a loan agreement

The following are some important questions to consider when drafting a loan agreement:

- What is the purpose of the loan?

- Does the borrower have enough collateral to secure the loan?

- How long will it take for repayment?

- What interest rate does the borrower agree to pay?

how to write a loan agreement template

how to draw up a loan agreement between friends

what is a demand loan agreement

In these types of loans, there is an understanding that the borrower may not be able to repay all of their outstanding debt and thus they are not eligible for a full refund.

Demand loans are typically unsecured loans, which means there is no collateral that backs the loan. This means that if you default on your payment plan, you will lose your property and assets to cover your debt.

what is a loan agreement and why is it important

Loan agreements are important because they help protect both parties from future disputes and provide some peace of mind when making an investment in someone else's business.

The most important thing to remember when creating a loan agreement is to make it clear who will be responsible for paying back the loan. In this case, you would need to decide whether you want to be responsible or if you want your business partner to be.

how to make a personal loan agreement template

how to write a family loan agreement

The main purpose of this agreement is to protect both parties involved in the transaction. It outlines what each party will do with their money and property, as well as what rights they have over the other party.

how to write up a loan agreement

- The identity of both parties;

- The nature and purpose of the loan;

- The interest rate and repayment schedule;

- The amount to be borrowed and its value;

- Legal terminology such as "lien" or "mortgage".

how do i write a personal loan agreement

If you're looking for a way to structure your loan agreement, consider these steps:

1) Determine your goals.

2) Determine what you need from the agreement.

3) Write your terms and conditions.

4) Organize your document into sections and subsections.

How do I convert this personal loan agreement template word?

Then, customize the bracketed sections by adding your own content, and review the rest of the contract. Once it is to your liking, use the file saving options on your program or a file converting website to save it as your desired file type.

can you cancel a personal loan agreement?

how to draft a personal loan agreement

The agreement should be drafted with the following in mind:

- The amount of money you are borrowing and how long it will take to pay back.

- The interest rate.

- The repayment schedule.

how do i write a simple personal loan agreement

The key sections of a personal loan agreement are:

- The term, which gives both parties an idea of how long they will be borrowing and repaying money

- The principal amount, which is how much money you are borrowing

- The interest rate, which is how much you will be paying back in interest each month

- A description of what happens if you fail to pay back your loan on time

how to write a loan agreement with collateral

- Make sure that you have a clear understanding of what you want to borrow and what you will be lending out.

- Write your agreement in plain language, without jargon or legal terms.

- Keep your contract short and concise, while still including all necessary information in it.

how to write a simple loan agreement

how to write up a personal loan contract

Here are some things that you should keep in mind while writing a personal loan agreement:

- Ensure that all terms are clearly defined in your contract.

- Make sure that all clauses are written in plain language so there is no room for misinterpretation.

- Include an escape clause so that if something goes wrong, both parties can exit the contract without penalty.

how to write a contract for a personal loan

It's important to make sure that your contract is written in plain language so it's easy for anyone to understand without having any complications in understanding it. It's also important to keep track of all the changes made through time so that if something changes after signing your contract, you can go back and amend it accordingly.

Send Contracts in Minutes

Unlock the power of WP E-Signature on your website using your branding today!

Get Started Now