Bookkeeping Contracts: What You Need to Know

As a small business owner, you may have used bookkeeping software or accounting software like Quickbooks or tracked your cash flow using Microsoft Excel. But at some point, you may wish to engage Bookkeeping contracts, also known as accounting contracts, bookkeeping contract agreements, bookkeeping agreements, or bookkeeping services contracts. This contract is between a company or client and the bookkeeper who will offer the bookkeeping services. A contract is important because it protects your legal rights and clearly outlines both parties’ responsibilities. You should use a bookkeeping contract under the following conditions:

- If you represent an accounting firm that is going to handle a new client’s bookkeeping activities and would like each party’s responsibilities to be clearly defined.

- If you are a bookkeeper taking on a new client and want to have a contract set up prior to providing accounting and bookkeeping services.

- If you want to hire an accountant to control your accounting activities and would like a written agreement defining the scope of their services.

- If you are a business owner and are looking to hire an accountant, accounting firm, or bookkeeper to handle specific aspects of your business finances.

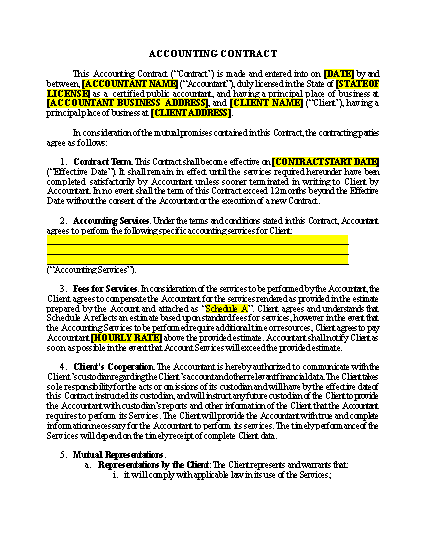

Contents of a Bookkeeping Contract A bookkeeping contract spells out the services that the bookkeeper (accountant or accounting firm) will perform for your small business or company. These services may include journal entries, balance sheets, cash flow statements, Accounts receivable, loss statements, petty cash, full reporting, and monthly financial statements. It also describes the liabilities and responsibilities of each party. An accountant may be responsible for only individual taxes or for maintaining all bookkeeping, corporate financials, and taxes on a business. The contract should also include:

- The accounting firm or accountant’s name and address

- The client’s name and address

- The date of commencement of the agreement and an indication of how long it is going to remain in effect

- The services offered by the accountant to the client

- How bookkeeping services will be compensated

- State laws that govern the agreement

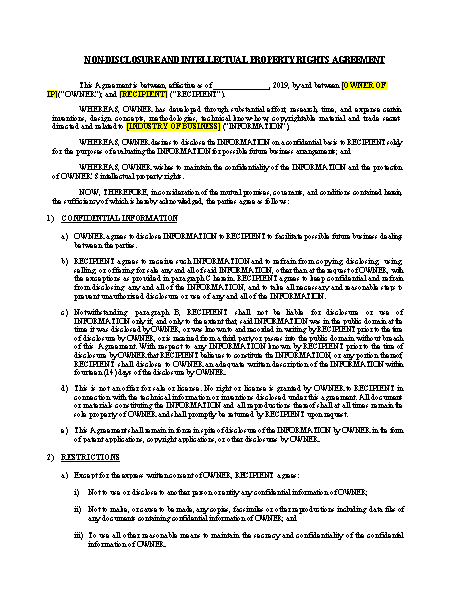

A bookkeeping contract should address some core areas and concepts that must be clearly defined to eliminate any miscommunication or misunderstanding of what role each the Client and the bookkeeper will be providing. Here are some of the most important points to be addressed in the bookkeeping contract: Services The Accountant’s services should be clearly defined. They may only be involved in accounts receivable or cash flow, balance sheets, business expenses, bank reconciliation, payroll or perhaps they are preparing monthly financials. Whatever the role, their duties should be clearly identified. Performance The accountant swears to perform all their listed services as per the high standards clearly stated by the National Tax Preparers’ Association and the National Association of Accountants. Material and Data Access The accountant is provided with a full access to the client’s financial records and accounts. The accuracy of the existing financial records is the full responsibility of the client. Confidentiality The bookkeeper will have access to the most important data of your business. In order to protect your business or any trade secrets, there should be a clause addressing an expectation of confidentiality between the parties. Contract Term The bookkeeping contract comes into effect on the created date and proceeds on a month to month basis. It is ended by a cancellation by either party. Independent Contractor The accountant is engaged as an independent contractor as per the agreement of the client. The accountant shall therefore not be considered an agent of the client, a broker or an employee. The accountant or bookkeeper is not a direct employee and is providing their services to set up an accounting system or bookkeeping system to help you better manage your small business. Payment Payment terms and methods should be well defined. Whether the accountant submits an itemized invoice or if the client pays the accountant a monthly rate; in either event it should be stated how payment will be set up and issued. As with any contract, you should be aware of all terms and conditions that you are agreeing to with another party. A well prepared contract will protect you and define the relationship between you and the other party. If you are ever unclear about what you are agreeing to or what you should include to protect you and your business, you should seek the advice of legal counsel.

Your Signing experience is worth celebrating!

ApproveMe is easy document signing for busy people. Built on the belief that every new agreement with a customer or client should be celebrated.

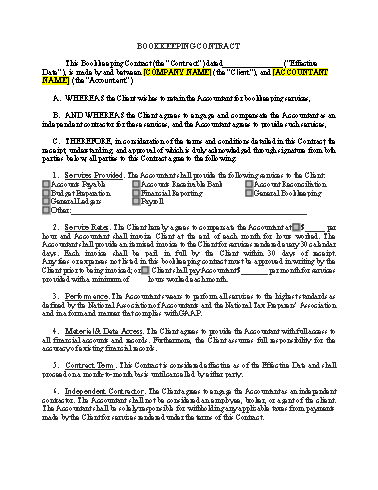

BOOKKEEPING CONTRACT

This Bookkeeping Contract (the “Contract”) dated________________ (“Effective Date”), is made by and between [COMPANY NAME] (the “Client”), and [ACCOUNTANT NAME] (the “Accountant”) A. WHEREAS the Client wishes to retain the Accountant for bookkeeping services, B. AND WHEREAS the Client agrees to engage and compensate the Accountant as an independent contractor for these services, and the Accountant agrees to provide such services, C. THEREFORE, in consideration of the terms and conditions detailed in this Contract, the receipt, understanding, and approval of which is duly acknowledged through signature from both parties below, all parties to this Contract agree to the following: 1. Services Provided. The Accountant shall provide the following services to the Client: 0Accounts Payable 0Accounts Receivable Bank 0Account Reconciliation 0Budget Preparation 0Financial Reporting 0General Bookkeeping 0General Ledgers 0Payroll 0Other:_______________________________________________________________ 2. Service Rates. The Client hereby agrees to compensate the Accountant at 0$_____ per hour and Accountant shall invoice Client at the end of each month for hours worked. The Accountant shall provide an itemized invoice to the Client for services rendered every 30 calendar days. Each invoice shall be paid in full by the Client within 30 days of receipt. Any fees or expenses not listed in this bookkeeping contract must be approved in writing by the Client prior to being invoiced; or 0 Client shall pay Accountant $_______ per month for services provided with a minimum of ____ hours worked each month. 3. Performance. The Accountant swears to perform all services to the highest standards as defined by the National Association of Accountants and the National Tax Preparers’ Association and in a form and manner that complies with GAAP. 4. Material & Data Access. The Client agrees to provide the Accountant with full access to all financial accounts and records. Furthermore, the Client assumes full responsibility for the accuracy of existing financial records. 5. Contract Term. This Contract is considered effective as of the Effective Date, and shall proceed on a month-to-month basis until cancelled by either party. 6. Independent Contractor. The Client agrees to engage the Accountant as an independent contractor. The Accountant shall not be considered an employee, broker, or agent of the client. The Accountant shall be solely responsible for withholding any applicable taxes from payments made by the Client for services rendered under the terms of this Contract. 7. Confidentiality. During the term of this Contract, it may be necessary for Client to share proprietary information, including trade secrets, industry knowledge, and other confidential information, to Accountant in order for Accountant to complete the Services. Accountant will not share any of this proprietary information at any time. Accountant also will not use any of this proprietary information for his/her personal benefit at any time. This section remains in full force and effect even after termination of the Agreement by it’s natural termination or the early termination by either party. The Accountant agrees that the Accountant’s obligation not to disclose or to use information and materials of the types set forth in this paragraph, and the Accountant’s obligation to return materials and tangible property, also extends to such types of information, materials and tangible property of customers of the Client or suppliers to the Client or other third parties who may have disclosed or entrusted the same to the Client or to the Accountant in the course of the Client’s business. 8. Termination. This Contract may be terminated at any time by either party upon written notice to the other party. Client will be responsible for payment of all Services performed up to the date of termination, except for in the case of Accountant’s breach of this Contract, where Accountant fails to cure such breach upon reasonable notice. Upon termination, Accountant shall return all Client content, materials, and all work product to Client at its earliest convenience, but in no event beyond thirty (30) days after the date of termination. 9. Representations and Warranties. Both parties represent that they are fully authorized to enter into this Contract. The performance and obligations of either party will not violate or infringe upon the rights of any third-party or violate any other agreement between the parties, individually, and any other person, organization, or business or any law or governmental regulation. 10. Indemnity. The parties each agree to indemnify and hold harmless the other party, its respective affiliates, officers, agents, employees, and permitted successors and assigns against any and all claims, losses, damages, liabilities, penalties, punitive damages, expenses, reasonable legal fees and costs of any kind or amount whatsoever, which result from the negligence of or breach of this Contract by the indemnifying party, its respective successors and assigns that occurs in connection with this Contract. This section remains in full force and effect even after termination of the Contract by its natural termination or the early termination by either party. 11. Limitation of Liability. UNDER NO CIRCUMSTANCES SHALL EITHER PARTY BE LIABILE TO THE OTHER PARTY OR ANY THIRD PARTY FOR ANY DAMAGES RESULTING FROM ANY PART OF THIS AGREEMENT SUCH AS, BUT NOT LIMITED TO, LOSS OF REVENUE OR ANTICIPATED PROFIT OR LOST BUSINESS, COSTS OF DELAY OR FAILURE OF DELIVERY, WHICH ARE NOT RELATED TO OR THE DIRECT RESULT OF A PARTY’S NEGLIGENCE OR BREACH. 12. Disclaimer of Warranties. Accountant shall complete the Services for Client’s purposes and to Client’s specifications. ACCOUNTANT DOES NOT REPRESENT OR WARRANT THAT SUCH SERVICES WILL CREATE ANY ADDITIONAL PROFITS, SALES, EXPOSURE, BRAND RECOGNITION, OR THE LIKE. ACCOUNTANT HAS NO RESPONSIBILITY TO CLIENT IF THE DELIVERABLES DO NOT LEAD TO CLIENT’S DESIRED RESULT(S). 13. Severability. In the event any provision of this Contract is deemed invalid or unenforceable, in whole or in part, that part shall be severed from the remainder of the Contract and all other provisions should continue in full force and effect as valid and enforceable. 14. Waiver. The failure by either party to exercise any right, power or privilege under the terms of this Contract will not be construed as a waiver of any subsequent or further exercise of that right, power or privilege or the exercise of any other right, power or privilege. 15. Legal Fees. In the event of a dispute resulting in legal action, the successful party will be entitled to its legal fees, including, but not limited to its attorneys’ fees. 16. Legal and Binding Agreement. This Contract is legal and binding between the parties as stated above. This Contract may be entered into and is legal and binding both in the United States and throughout Europe. The parties each represent that they have the authority to enter into this Contract. 17. Governing Law and Jurisdiction. The parties agree that this Contract shall be governed by the State and/or Country in which both parties do business. In the event that the parties do business in different States and/or Countries, this Contract shall be governed by _________ law. 18. Entire Agreement. The parties acknowledge and agree that this Contract represents the entire agreement between the parties. In the event that the parties desire to change, add, or otherwise modify any terms, they shall do so in writing to be signed by both parties. The parties agree to the terms and conditions set forth above as demonstrated by their signatures as follows: CLIENT: ________________________ [Client Name] [Client Address] [Client Address] [Client Phone] [Client Email] ACCOUNTANT: ________________________ [Accountant Name] [Accountant Address] [Accountant Address] [Accountant Phone] [Accountant Email]

Frequently Asked Questions

What is a bookkeeping contract?

A bookkeeping contract can be used to set expectations between the parties involved in a business relationship, such as an employer and employee, or client and service provider. The most important feature of a bookkeeping contract is that it clearly lays out what will happen if one party doesn't fulfill their duty or responsibility.

How much do contract bookkeepers charge?

They usually charge a flat fee for their service and can also offer other services that can be customized to suit the needs of their clients. The average cost for contract bookkeepers can vary, but can be an hourly rate of $25-$50 per hour.

What does bookkeeping services include?

How do I protect myself as a bookkeeper?

Do I need a contract with my accountant?

Does a bookkeeper must be registered to contract as a bookkeeper?

Does a bookkeeper need to have a contract?

Does a bookkeeper need to have a contract for services?

How to become a contracted bookkeeper

How to find bookkeeping contracts

How to find contract bookkeeping work

What are the most important qualities in a contract bookkeeper?

Important qualities in a contract bookkeeper include:

- Excellent time management skills

- Ability to work on their own without supervision

- High level of attention to detail and accuracy

What do contract bookkeepers charge?

What is a Bookkeeping Contract?

Who needs a Bookkeeping Contract?

How to write a Bookkeeping Contract

To write your own bookkeeping contract, you can start by downloading the free bookkeeping contract template on this page. Then you can add your specific information to the bracketed areas and edit the content as needed for your business.

What must a Bookkeeping Contract have?

- Scope of work

- Payment terms

- Timeframes for completion

- The fee for services provided

- How disputes will be resolved

Do Bookkeeping Contract’s have to be in writing?

What should I put in my Bookkeeping Contract?

- A fixed fee for the service

- The services to be performed

- The duties and responsibilities of both parties

- The terms and conditions of the contract

- The duration of the agreement

How to make a Bookkeeping Contract

- The services that are being provided

- The rate paid for those hours

- The performance expectations

- Contract terms and confidentiality information

- Termination

How long are Bookkeeping Contract good for?

The length of this contract will depend on how often the bookkeeper needs to provide these services and what exactly they are. Depending on how often you need your bookkeeper to provide these services, there would be different lengths of time for you to use this contract with them.

What are some Bookkeeping Contract examples?

Send Contracts in Minutes

Unlock the power of WP E-Signature on your website using your branding today!

Get Started Now