Financial Planning & Advice Contract Template for Financial Advisors

Introduction:

Financial advice is sought for many different reasons. Individuals may need investment advice, stocks and bonds, estate planning, etc. Financial advisors become trusted confidants as money is something that is obviously very personal. They have worked hard to earn that money and want to feel that they are being given good solid advice in how to protect it and potentially make it grow. By having a straightforward and clearly written agreement, all basic arrangements will be understandable to your client.

Key Points:

- Make any terms of a contract explicitly clear for the benefit of both you and your client in knowing what to expect in connection with the services to be provided.

- Be sure to have excellent insurance coverage for your practice. Use an agent familiar with the financial advisory business. Discuss “exclusion for discretionary advice” and “consent to settle” clauses/coverages with your insurance agent.

- Payment methods: hourly fee or fixed fee

- Hourly fee is a way in which an advisor is paid just like an hourly employee. Clients are expected to pay for each hour or part of an hour. Clients should expect to pay for time spent by all professionals. The contract should state how often the advisor will be paid [weekly, monthly, etc.]

- Fixed fee is a way in which a client is charged a fixed amount for a matter. This may be used if the matter is a one-time deal…it’s done and over.

Helpful Information:

- Financial advisors are regulated – check the Securities & Exchange Commission website (link below) for more information

- Be aware that a potential client may look at the firm’s Form ADV filed with the SEC to figure out what fees they may be charged for various advisory services. Keep all paperwork and filings current to ensure trust.

- A minimum standard for financial planning is a Certified Financial Planner (CFP) designation – be sure to have that designation prior to working with other people’s money as many people look for this basic assurance.

- Be sure your client has realistic expectations of investments and ROI. Many non-financial folks tend to see big returns in their future when performance cannot be fully guaranteed.

- Always ensure that you’ve taken appropriate stock of their individuals current financial situation and ensure that is a part of the terms of this agreement. Cash flow, investment portfolios, savings, bonds, money market accounts, property, assets, loans, debts, etc., should all be included in this area.

- Many clients may have interest in tax planning aligned with their investment and growth strategies, so be sure to offer some consideration to this area as well.

- Investment objectives may vary with each client as well, get to know them, their financial situation, and work with them in a way that is most comfortable, while targeting the returns and goals they have through your advisory contract.

- Read up on the Investment Advisers Act of 1940 (here) to ensure you operate your financial consulting in full compliance as well.

Signature:

A secure method to get an agreement signed is online. Online signatures of the parties are legally binding. This is a convenient way to expedite the process and eliminate stress for both you and the client.

You can use ApproveMe.com to ensure you have a legally binding signature.

Additional:

Some informational websites may be:

https://www.sec.gov/investment/laws-and-rules

https://www.govinfo.gov/content/pkg/COMPS-1878/pdf/COMPS-1878.pdf

Your Signing experience is worth celebrating!

ApproveMe is easy document signing for busy people. Built on the belief that every new agreement with a customer or client should be celebrated.

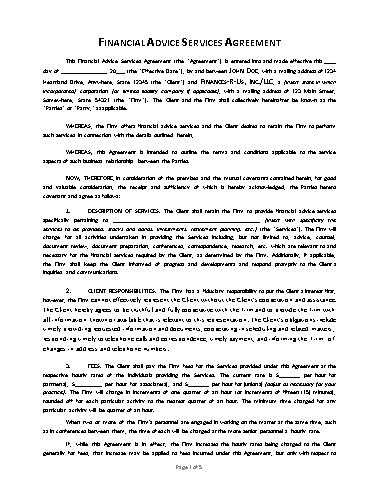

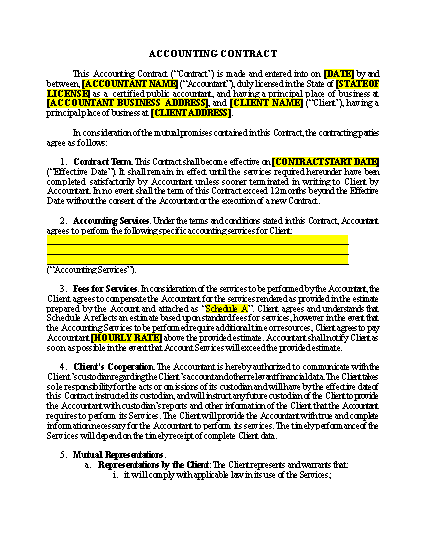

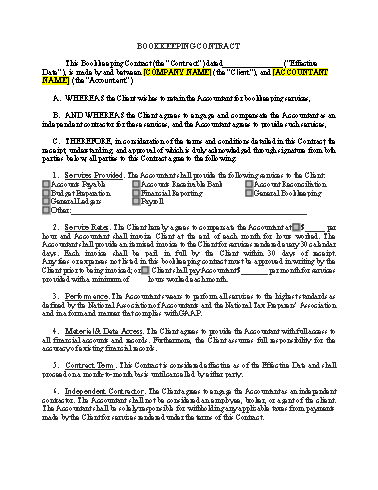

FINANCIAL ADVISOR CONSULTING AGREEMENT

This Financial Advice Services Agreement (the “Agreement”) is entered into and made effective this ____ day of _______________, 20___ (the “Effective Date”), by and between JOHN DOE, with a mailing address of 1234 Heartland Drive, Anywhere, State 12345 (the “Client”) and FINANCES-R-US, INC./LLC, a [insert state in which incorporated] corporation [or limited liability company if applicable], with a mailing address of 123 Main Street, Somewhere, State 54321 (the “Firm”). The Client and the Firm shall collectively hereinafter be known as the “Parties” or “Party,” as applicable.

WHEREAS, the Firm offers financial advice services and the Client desires to retain the Firm to perform such services in connection with the details outlined herein;

WHEREAS, this Agreement is intended to outline the terms and conditions applicable to the service aspects of such business relationship between the Parties.

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties hereto covenant and agree as follows:

1. DESCRIPTION OF SERVICES. The Client shall retain the Firm to provide financial advice services specifically pertaining to _________________________________________________ [insert with specificity the services to be provided: stocks and bonds, investments, retirement planning, etc.] (the “Services”). The Firm will charge for all activities undertaken in providing the Services including, but not limited to, advice, counsel, document review, document preparation, conferences, correspondence, research, etc. which are relevant to and necessary for the financial services required by the Client, as determined by the Firm. Additionally, if applicable, the Firm shall keep the Client informed of progress and developments and respond promptly to the Client’s inquiries and communications.

2. CLIENT RESPONSIBILITIES. The Firm has a fiduciary responsibility to put the Client’s interest first; however, the Firm cannot effectively represent the Client without the Client’s cooperation and assistance. The Client hereby agrees to be truthful and fully cooperative with the Firm and to provide the Firm with all information known or available that is relevant to this representation. The Client’s obligations include timely providing requested information and documents, cooperating in scheduling and related matters, responding timely to telephone calls and correspondence, timely payment, and informing the Firm of changes in address and telephone numbers.

3. FEES. The Client shall pay the Firm fees for the Services provided under this Agreement at the respective hourly rates of the individuals providing the Services. The current rate is $_______ per hour for partner(s), $_________ per hour for associate(s), and $_______ per hour for junior(s) [adjust as necessary for your practice]. The Firm will charge in increments of one quarter of an hour (or increments of fifteen (15) minutes), rounded off for each particular activity to the nearest quarter of an hour. The minimum time charged for any particular activity will be quarter of an hour.

When two or more of the Firm’s personnel are engaged in working on the matter at the same time, such as in conferences between them, the time of each will be charged at the more senior personnel’s hourly rate.

If, while this Agreement is in effect, the Firm increases the hourly rates being charged to the Client generally for fees, that increase may be applied to fees incurred under this Agreement, but only with respect to the Services provided thirty (30) days or more after written notice of the increase is mailed to the Client. If the Client chooses not to consent to the increased rates, the Client may terminate the Firm’s Services under this Agreement by written notice effective when received by the Firm.

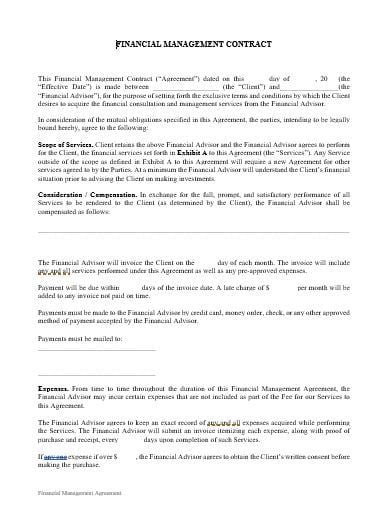

***if the arrangement is a FIXED fee, delete the above “Fees” section and insert the following paragraph***

3. COMPENSATION. In regard to the specific Services performed hereunder, the Parties agree to a fixed fee arrangement whereby the Firm will accept a fee of $___________________ [insert amount] for performance of the Services described herein (the “Compensation”). The Parties acknowledge and agree that the Compensation shall cover the Services provided by the Firm but that the Client shall pay any costs (as described below) incurred by the Firm in connection with the Services.

***if the arrangement is a PERCENTAGE OF ASSETS UNDER MANAGEMENT fee, delete the above “Fees” section and insert the following paragraph***

3. COMPENSATION. In regard to the specific Services performed hereunder, the Parties agree to a “percentage of assets under management” fee arrangement whereby the Firm will accept a fixed percentage of ___________________ [insert percentage – for example, One Percent (1%)] for ongoing portfolio management on behalf of the Client (the “Compensation”). The Parties acknowledge and agree that the Compensation shall cover the Services provided by the Firm but that the Client shall pay any costs (as described below) incurred by the Firm in connection with the Services.

4. COSTS. The Client shall pay for all actual out-of-pocket costs incurred on the Client’s behalf under this Agreement. Typical costs include: long distance telephone calls, outgoing fax (at $_______ per page), Federal Express, courier services, delivery charges, photocopying (at $__________ per page), and online database retrieval charges. The Firm may elect to cover certain out-of-pocket costs on behalf of the Client, but reserves the right to seek reimbursement. The Client agrees to reimburse the Firm for such out-of-pocket costs. The Client may, at any time, request a copy of the Firm’s file for his/her particular matter at the photocopy rate specified herein. Additionally, the Client shall pay all costs associated with mutual funds and/or exchange-traded funds (ETFs) if the Firm advises the Client that those funds are in his/her best interest.

5. RETAINER/ADVANCED DEPOSIT(S). If requested by the Firm, the Client shall pay to the Firm an initial deposit of $_____________ [insert retainer amount, e.g., One Thousand Dollars ($1,000.00)] to be received within five (5) business days [insert other time frame] from Effective Date of this Agreement. Any advance deposit(s) shall be deposited into the Firm’s client trust account. The Parties hereby agree, and the Client hereby knowingly authorizes, that the Firm shall deduct fees and costs from the advanced deposit(s) as fees are earned or costs are incurred. The Firm may require an additional advanced deposit of fees or costs. Any balance of the advanced deposit(s) remaining after the matter has concluded shall be refunded to the Client within thirty (30) days following conclusion. Alternatively, if there are fees and costs to be paid after the matter has concluded, the Client shall pay such to the Firm within thirty (30) days.

6. BILLING. If the Parties have agreed to an hourly rate fee arrangement, the Firm shall bill the Client on a monthly basis for services performed in the preceding month. The monthly statement will identify the services performed, the fees charged for those services, and costs incurred. The statement also will indicate the amount(s) applied from the advance deposit(s), if any, and identify the balance of any advanced deposit(s) remaining. The Client has ten (10) days from the date of the statement to contest any charges contained in the bill. If the Firm receives no communication from the Client, the bill will be deemed acceptable and the amount will be deducted from the remaining balance. If the Client’s advanced deposit(s) has been depleted, the Client is expected to remit payment within thirty (30) days of the date of the statement. If no fees or costs are incurred for a particular month, or if they are minimal, the statement may be held and combined with that for the following month.

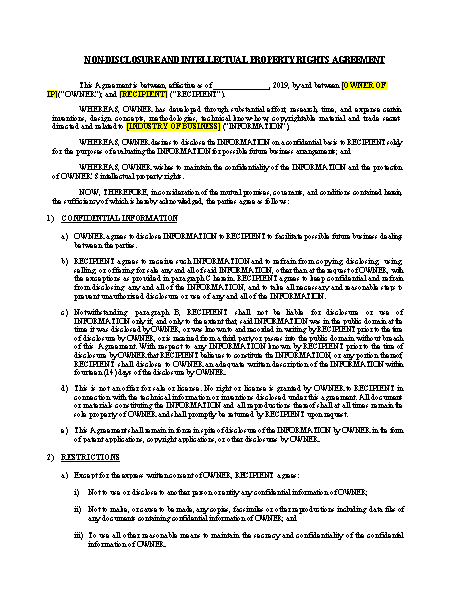

7. CONFIDENTIALITY. The Firm may, during the performance of the Services, overhear or be privy to business or propriety information discussed. Such information shall remain confidential and shall survive the termination of this Agreement.

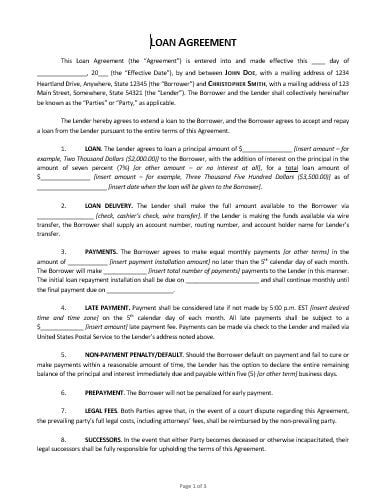

8. BACKGROUND CHECK; CRIMINAL RECORD. All the Firm staff members (if any) have been fully vetted and passed a background check, along with any international, federal, state, and local searches deemed necessary. No staff member has any criminal history relating to driving offenses and/or crimes associated with the consumption of alcoholic beverages, child abuse, violence directed at children, crimes against an individual (i.e., battery or assault of any kind), and is not listed as a sex offender on either a federal or state-based registry. Additionally, for purposes of federal immigration law, all staff members have provided the Firm with documentary evidence of identity and eligibility for employment in the United States.

9. LICENSE AND INSURANCE. The Firm is licensed and approved for doing business in the state, county, and/or city of the Services provided. The Firm acknowledges and agrees that this information may be subject to verification by the Client prior to the initiation of the Services. The Firm shall cooperate fully in providing the Client with requested supporting documentation.

The Firm shall maintain a policy(ies) of commercial general liability insurance with limits of liability of not less than One Million Dollars ($1,000,000) per occurrence and Two Million Dollars ($2,000,000) in the aggregate providing coverage for, among other things, professional liability/errors and omissions coverage. All insurance required to be maintained by the Firm pursuant to this Agreement shall be maintained with responsible companies qualified to do business, and in good standing, in the state of _______________ [insert state of Firm] and which have a rating of at least “A-” in the most current A.M. Best’s Insurance Guide or such similar rating as may be reasonably expected. If the Firm cannot or will not provide evidence of the appropriate insurance coverage within five (5) business days of the Effective Date herein, this Agreement shall terminate at that time and any advanced deposit(s) shall be refunded to the Client within five (5) business days of termination.

10. TERMINATION. Either Party may terminate the representation at any time, subject to the Firm’s obligations under any code of ethics and standard of conduct. Unless previously terminated, the Firm’s representation will terminate upon sending the final billing invoice, if applicable. Additionally, this Agreement shall terminate upon the occurrence of any of the following: (i) in the event either Party defaults in any material obligation owed to the other Party pursuant to this Agreement, then this Agreement may be terminated if the default is not cured following five (5) days’ written notice to the defaulting party and/or (ii) the Firm becomes bankrupt or insolvent, or bankruptcy or insolvency proceedings are instituted against the Firm and the proceeding is not dismissed within sixty (60) days of commencement.

11. MEDIATION AND ARBITRATION. Any dispute, claim, or controversy arising from or relating to this Agreement and/or attorney’s fees must exclusively be resolved first by mediation with a single mediator selected by the Parties, with such mediation to be held in ___________ [City], ________ [State]. If such mediation fails, then any such dispute shall be resolved by binding arbitration under the Commercial Arbitration Rules of the American Arbitration Association in effect at the time the arbitration proceeding commences, except that (a) _______ [state of Firm] law and the Federal Arbitration Act must govern construction and effect, (b) the locale of any arbitration must be in ___________ [City], ________ [State], and (c) the arbitrator must with the award provide written findings of fact and conclusions of law. Any Party may seek from a court of competent jurisdiction any provisional remedy that may be necessary to protect its rights or assets pending the selection of the arbitrator or the arbitrator’s determination of the merits of the controversy. The exercise of such arbitration rights by any Party will not preclude the exercise of any self-help remedies (including without limitation, setoff rights) or the exercise of any non-judicial foreclosure rights. An arbitration award may be entered in any court having jurisdiction.

12. APPLICABLE LAW. This Agreement shall be construed and governed by the law of the state of [insert state of Firm] without regard to principles of conflicts of law

13. MISCELLANEOUS.

a. No Waiver. The failure of a Party to require strict performance of any provision of this Agreement by the other, or the forbearance to exercise any right or remedy, shall not be construed as a waiver by such Party of any such right or remedy or preclude any other or further exercise thereof or the exercise of any other right or remedy.

b. Severability. The invalidity or unenforceability of any provision of this Agreement does not affect the validity or enforceability of any other provision of this Agreement.

c. Entire Agreement; Amendments. This Agreement has been freely negotiated and contains the entire understanding between the Parties for the Services outlined herein. The Parties acknowledge that they have read and understand the terms contained herein and agree to same. This Agreement supersedes all prior agreements, representations, or understanding (whether written, oral, implied, or otherwise) between the Parties. These terms may not be amended or modified, in whole or in part, except by an express written agreement between the Parties.

d. Headings. The headings in this Agreement are for purposes of reference only and shall not limit or otherwise affect the meaning of any provision of this Agreement.

e. Counterparts; Facsimile and Electronic Signatures. This Agreement may be executed in counterparts, all of which together shall constitute one and the same agreement. Any electronic signature shall have the full weight and authority as an original signature on this Agreement. Additionally, any signature page delivered electronically or by facsimile shall be binding to the same extent as an original signature page with regards to any agreement subject to the terms hereof or any amendment hereto.

IN WITNESS WHEREOF, the Parties have executed this Agreement as identified below and as of the Effective Date of this Agreement.

“CLIENT”

JOHN DOE

_____________________________________________

Signature

“FIRM”

FINANCES-R-US, INC./LLC

___________________________________________

Signature of Authorized Firm Representative

___________________________________________

Printed Name of Authorized Firm Representative

Send Contracts in Minutes

Unlock the power of WP E-Signature on your website using your branding today!

Get Started Now