Payment Agreement Template

A payment agreement is an important contract between a lender and borrower that spells out the terms and payment obligations of a loan. A payment agreement can be between family members or more formally in a business setting. A loan agreement is fundamental to ensure the lender is protected. What is in the Payment Agreement Template?

- A payment agreement simply outlines the terms of a loan.

- The agreement sets a borrower’s financial obligations and implements a payment plan.

- A payment agreement provides a lender with a legal remedy should the borrower breach the payment contract.

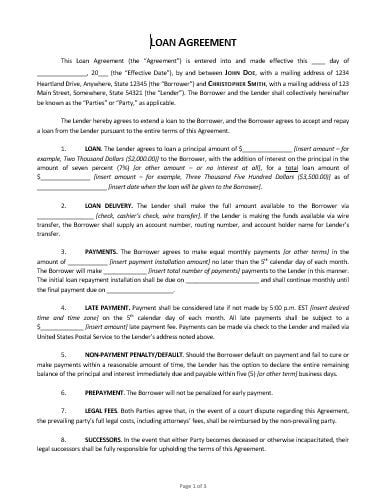

- Other names for a payment agreement include Loan Agreement, Payment Contract, Payment Plan Agreement, Installment Agreement, Business Payment Agreement, Personal Payment Agreement, and IOU.

When is a Payment Agreement Needed? A payment agreement is needed anytime money is being loaned. If there is not a valid agreement in place, the lender may be left without any legal recourse. It can be challenging to prove that the parties agreed without an executed and detailed payment plan in place. A payment agreement is necessary if you plan to borrow money or if you intend to lend money. Why do you Need a Payment Agreement? A payment agreement is a formal, legally binding contract that is essential when money is being loaned. The party lending the money is commonly referred to as the “lender.” The party receiving the funds is commonly referred to as the “borrower.” Establishing a payment plan clearly documents the borrower’s financial obligation to the lender. Should the borrower default on the payments due under the agreement, the lender is provided with a legal remedy. Having all of the loan and payment details in one document eliminates confusion while providing the lender with proper assurances. What Should be Included in a Payment Agreement? A payment agreement establishes the terms and agreement of a loan. Here are a few essential elements of a simple payment agreement:

- Parties to the agreement (Lender/Borrower)

- Effective Date

- Total Amount of the Loan (Financial Obligation/Amount of Money)

- Payment Plan / Installments

- Payment Due Dates and Late Fees or other Penalties

- Indemnification provision

- Dispute Resolution

- Accurate Contact Information for all Parties to the Contract

Common Mistakes to Dodge when Drafting a Payment Agreement Payment agreements are the best way to ensure both the borrower and the lender are on the same page about the financial obligations of the loan. Some common mistakes include:

- Failing to state the total loan amount

- Excluding a reasonable and attainable payment plan

- Payment amount, Payment schedule, and penalties

- Obtaining all appropriate signatures

- Neglecting to consult with an attorney to receive legal advice

How to Tailor your Payment Agreement Every payment agreement will differ based on the loan amount and other specific circumstances. Each state may have different state laws regarding what should and should not be allowed in a loan. It is important to reach out to an experienced attorney to review a proposed payment agreement. Electronic Signatures Facilitate the Signature Process Electronic signatures save time and expedite the signature process. ApproveMe.com helps get your company’s documents signed as soon as possible, so your company does not miss a beat. Other Financial Resources for your Company When it comes to money and finances, organization is a must. Check out the links below links to some helpful financial, organizational software for small businesses:

Your Signing experience is worth celebrating!

ApproveMe is easy document signing for busy people. Built on the belief that every new agreement with a customer or client should be celebrated.

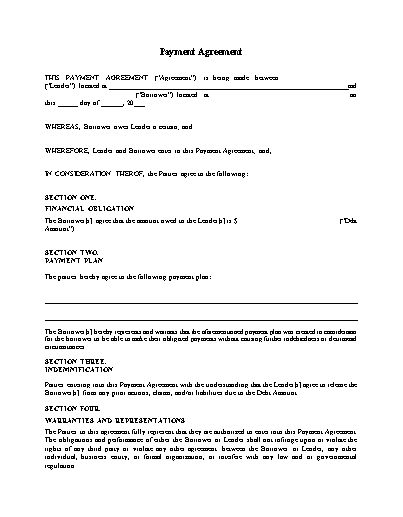

Payment Agreement

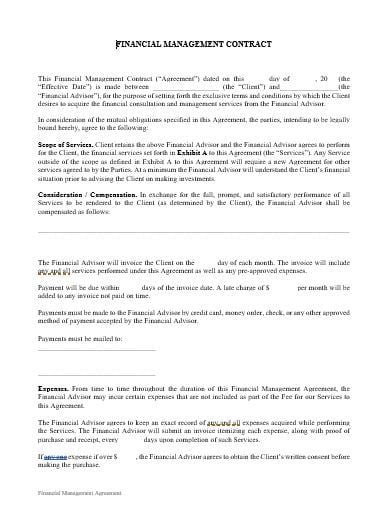

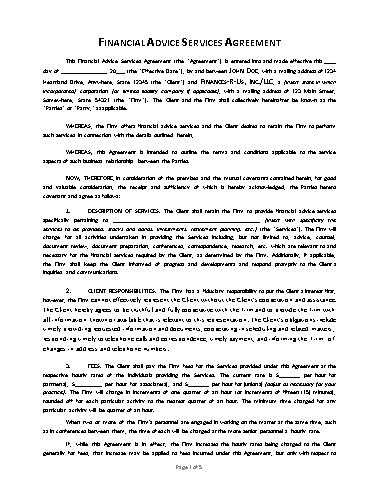

THIS PAYMENT AGREEMENT (“Agreement”) is being made between ____________________ (“Lender”) located at _________________________________________________________________and ________________________(“Borrower”) located at_____________________________________ on this _____ day of ______, 20___. WHEREAS, Borrower owes Lender a certain; and WHEREFORE, Lender and Borrower enter in this Payment Agreement; and, IN CONSIDERATION THEROF, the Parties agree to the following: SECTION ONE. FINANCIAL OBLIGATION The Borrower[s] agree that the amount owed to the Lender[s] is $___________________________ (“Debt Amount”) SECTION TWO. PAYMENT PLAN The parties hereby agree to the following payment plan: ____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ The Borrower[s] hereby represents and warrants that the aforementioned payment plan was created in consideration for the borrower to be able to make their obligated payments without causing further indebtedness or detrimental circumstances. SECTION THREE. INDEMNIFICATION Parties entering into this Payment Agreement with the understanding that the Lender[s] agree to release the Borrower[s] from any prior actions, claims, and/or liabilities due to the Debt Amount. SECTION FOUR. WARRANTIES AND REPRESENTATIONS The Parties to this agreement fully represent that they are authorized to enter into this Payment Agreement. The obligations and performance of either the Borrower or Lender shall not infringe upon or violate the rights of any third party or violate any other agreement between the Borrower or Lender, any other individual, business entity, or formal organization, or interfere with any law and or governmental regulation. SECTION FIVE. SEVERABILITY In the event any part or provision of this Payment Agreement is deemed unenforceable or invalid, in part or in whole, that part shall be severed from the remainder of the Payment Agreement and all other parts or provisions shall continue in full force and effect as valid and enforceable. SECTION SIX. WAIVER No waiver by any Party of any of the provisions hereof shall be effective unless explicitly set out in writing and signed by the Party so waiving. No waiver by any Party shall operate or be construed as a waiver in respect of any failure, breach, or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or after that waiver. No failure to exercise, or delay in exercising, any right, remedy, power, or privilege arising from this Agreement shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power, or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power, or privilege. SECTION SEVEN. DEFAULT In the event that the borrower[s] default on any payments and fail to cure the default within a reasonable amount of time, the Lender[s] will have the option to accelerate and declare the entire remaining amount of the Principal and any accrued interest to be immediately due and payable. SECTION EIGHT. DISPUTE RESOLUTION Parties to this Agreement shall first attempt to settle any dispute through a good-faith negotiation. If the dispute cannot be settled between the parties via negotiation, either party may initiate mediation or binding arbitration in the State of ________________. If the parties do not wish to mediate or arbitrate the dispute and litigation is necessary, this Agreement will be interpreted based on the laws of the State of _________________, without regard to the conflict of law provisions of such state. The Parties agree the dispute will be resolved in a court of competent jurisdiction in the State of ______________________. The prevailing party to the dispute will be able to recover its attorney’s fees and other reasonable costs for a dispute resolved by litigation or binding arbitration. SECTION NINE. GOVERNING LAW AND JURISDICTION The laws of the State of _______________ shall govern as to the interpretation, validity, and effect of this Agreement. SECTION TEN. ENTIRE AGREEMENT This Agreement constitutes the sole and entire agreement of the Parties regarding the subject matter contained herein, and supersedes all prior and contemporaneous understandings, agreements, representations, and warranties, both written and oral, regarding such subject matter. This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by each Party hereto. SECTION ELEVEN. COUNTERPARTS This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile. email, or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement. SECTION TWELVE ELECTRONIC SIGNATURES This Agreement and related documents entered into in connection with this Agreement are signed when a party’s signature is delivered electronically, and these signatures must be treated in all respects as having the same force and effect as original signatures. SECTION THIRTEEN MISCELLANEOUS This Agreement cannot be changed, modified, terminated, canceled, rescinded, or in any other way altered or negated unless the same is in writing and signed by the party against whom enforcement of the change, modification, discharge, termination, cancellation, or rescission is sought. It is agreed that all understandings and agreements heretofore had between the parties are merged in this Agreement, which alone fully and completely expresses their understanding, and this Agreement has been entered into after full investigation and consideration, neither party relying upon any statement or representation, not embodied in this Agreement, which may be claimed to have been made by any of the parties hereto. IN WITNESS WHEREOF, the BORROWER[S] and the LENDER[S] have executed this PAYMENT AGREEMENT the day and year first above written. Dated:_____________________________ ________________________________________ Lender[s] Signature ________________________________________ Lender[s]Printed Name Lender[s] Contact Information: Address: ______________________________ Phone Number: _________________________ Email Address: _________________________ Dated:_____________________________ ________________________________________ Borrower[s] Signature ________________________________________ Borrower[s]Printed Name Borrower[s] Contact Information: Address: ______________________________ Phone Number: _________________________ Email Address: _________________________

Frequently Asked Questions

How to write a contract agreement for payment

The contract agreement should be clear and concise so that both parties understand what is expected of them. It should also include a deadline for completing the work or providing services to ensure that deadlines are met.

How to type a payment agreement letter

- A header with the date, names of both parties, and address

- The date by which the original balance must be paid in full - The total amount owed by both parties as of today's date

- The amount that each party will pay on each installment (if applicable)

- The number of installments (if applicable)

- A statement that if any payments are not made on time or if any other part of the agreement is violated then all previous payments will be considered null

How to write a payment agreement for a personal debt

How to write a payment agreement

The agreement outlines the details of the transaction, including what has been delivered, when it will be paid for and who will bear any risks if there is a delay in payment. The agreement can also include information about who owns the intellectual property rights to what has been delivered and how disputes will be resolved.

How do I write a payment agreement?

Agreement date, agreement number, parties involved in the agreement, information about the goods/services being traded, information about payments to be made by each party, and payment terms and conditions

Once you have collected this information, use the ApproveMe.com template on this page to get started.

What is payment agreement?

It is important for both parties to understand the terms and conditions in the agreement before signing it.

This contract template is for a simple payment agreement between two parties, where one party agrees to provide goods or services and the other party agrees to make payments according to agreed-upon terms.

What is a payment agreement contract?

Who needs a payment contract template?

Businesses use these documents to make sure they have solid terms set up with vendors that provide goods and services.

Vendors use these documents to make sure they are paid for the goods and services they provide, according to the agreed upon terms.

How to write a payment contract template

The template will typically include the date, the names of both parties, and any specific details about the transaction. It may also include information about the type of currency that will be used, as well as any applicable taxes or other fees.

There are many different types of payment contracts, but they all serve to outline what each party is responsible for in terms of making payments and fulfilling their obligations under the agreement.

What must a payment contract template have?

- The name of the company or individual who will be providing the service or product

- The date when the services will start and end

- The amount of money or other form of payment that will be exchanged for those services

- The method by which payments will be made (i.e., cash, check, credit card)

- Any extra fees that may apply for late payments or payments made outside agreed upon terms

Do payment contract template’s have to be in writing?

You can avoid misunderstandings, disputes, and loss of time and money by simply having your payment agreement contract template in writing and signed by all parties involved.

What should I put in my simple payment agreement template?

-The names and addresses of the parties;

-A description of what is being sold and how much it costs;

-The terms of payment, including when and how often payments will be made;

-The date by which the customer must pay for the goods or services.

How to make a payment contract template

There are many details that need to be included in your template, including what is being sold, how much it costs, when it will be delivered, how it will be delivered, what happens if there are any problems with the product or service provided, how payments will be made

How long are payment contract template good for?

The important part is that the terms and conditions are clearly stated and agreed on by both parties. Once the document is signed, the terms are in place and must be kept.

What are some payment contract template examples?

Send Contracts in Minutes

Unlock the power of WP E-Signature on your website using your branding today!

Get Started Now