Accounting Contracts: What You Need to Know

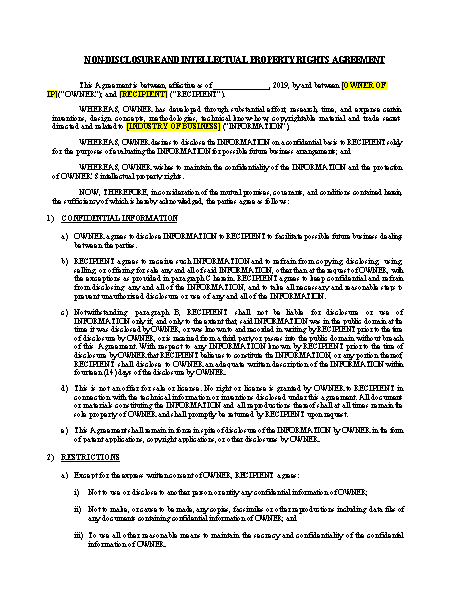

As an accountant, you want to grow your business and develop new clients. Your reputation, skillset and professionalism may assist you in obtaining that goal but having a well worded contract will protect you to keep your clients and protect you both during the nature of your working relationship as you provide accounting services. Many people cringe at the thought of using a contract, however it is important because it protects your work and clearly outlines both parties’ responsibilities. This understanding upfront can be the difference between a simple disagreement easily resolved or a lengthy and expensive lawsuit. In addition, having a contract will give you and your business the impression of professionalism, organization and competency. It is difficult enough being a small business owner or independent contractor, why not give yourself a leg up against your competition. The contract you have your client execute should have these main points addressed: Names of the Parties. Your contract should state who you are, where you are licensed and provide your business information. This should be the same for the client. This may seem like a simple statement but what if you are doing services for a company but the contract is between you and an individual. If you fail to receive payment, you cannot seek payment from the company because the contract is between you and an individual who may or may not have authority to enter into contracts on behalf of the company. In addition, when you are obligated to provide a notice to your client, you want to make sure you have as much contact information as possible, so why not gather it and put it into your contract. Term of the Contract. You should set out a term you want the contract to extend but keep the length no more than a year. Anything may happen in a years time and you do not want to be tied to a difficult client, a client that owes you money, an uncooperative client or prevent you from raising your rates with an existing client. Services. The most important section of the contract with be the definition of what services you will be providing. Is this going to be a one-time audit or perhaps tax returns, financial statements, reviewing accounts payable or accounts receivable. You want to be specific and state clearly in the contract so that the communication and understanding between you and the client is not shrouded in a gray cloud. Your accounting services should also be clarified to state how and when they will be provided; on a monthly basis, one-time basis or annual basis. Fees. The second most important section of the contract is how are you going to be paid for the account services you will provide. You should leave yourself the flexibility to protect yourself in the event you find that a seemingly straight forward account project has turned into a nightmare and you are losing money as your time and resources are consumed by this one project. Preparing an estimate of the services you plan on completing together with including an hourly rate in the event a nightmare ensues, is just one way to maintain that flexibility. In addition, your contract will include such things that you will find in most legal documents or contract templates; protecting confidential information, the governing law of the contract, limitation of liability and termination of this agreement. The best contracts are those that are easily understood, are straight to the point and protect you and your business. A contract can always be amended, revised, renewed or modified- it is a negotiable document. The money, protection, time and peace of mind a contract can provide is priceless compared to the cost a lawsuit can inflict upon you and your professional reputation.

Your Signing experience is worth celebrating!

ApproveMe is easy document signing for busy people. Built on the belief that every new agreement with a customer or client should be celebrated.

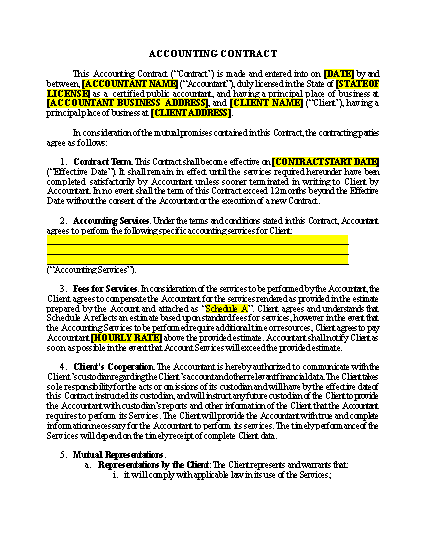

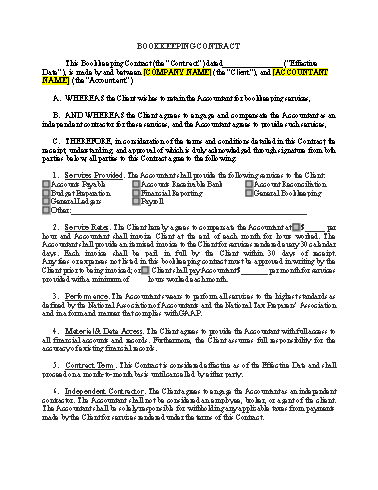

ACCOUNTING CONTRACT

This Accounting Contract (“Contract”) is made and entered into on [DATE] by and between, [ACCOUNTANT NAME] (“Accountant”), duly licensed in the State of [STATE OF LICENSE] as a certified public accountant, and having a principal place of business at [ACCOUNTANT BUSINESS ADDRESS], and [CLIENT NAME] (“Client”), having a principal place of business at [CLIENT ADDRESS]. In consideration of the mutual promises contained in this Contract, the contracting parties agree as follows: 1. Contract Term. This Contract shall become effective on [CONTRACT START DATE] (“Effective Date”). It shall remain in effect until the services required hereunder have been completed satisfactorily by Accountant unless sooner terminated in writing to Client by Accountant. In no event shall the term of this Contract exceed 12 months beyond the Effective Date without the consent of the Accountant or the execution of a new Contract. 2. Accounting Services. Under the terms and conditions stated in this Contract, Accountant agrees to perform the following specific accounting services for Client: ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ (“Accounting Services”). 3. Fees for Services. In consideration of the services to be performed by the Accountant, the Client agrees to compensate the Accountant for the services rendered as provided in the estimate prepared by the Account and attached as “Schedule A”. Client agrees and understands that Schedule A reflects an estimate based upon standard fees for services, however in the event that the Accounting Services to be performed require additional time or resources, Client agrees to pay Accountant [HOURLY RATE] above the provided estimate. Accountant shall notify Client as soon as possible in the event that Account Services will exceed the provided estimate. 4. Client’s Cooperation. The Accountant is hereby authorized to communicate with the Client’s custodian regarding the Client’s account and other relevant financial data. The Client takes sole responsibility for the acts or omissions of its custodian and will have by the effective date of this Contract instructed its custodian, and will instruct any future custodian of the Client to provide the Accountant with custodian’s reports and other information of the Client that the Accountant requires to perform its Services. The Client will provide the Accountant with true and complete information necessary for the Accountant to perform its services. The timely performance of the Services will depend on the timely receipt of complete Client data. 5. Mutual Representations. a. Representations by the Client: The Client represents and warrants that: i. it will comply with applicable law in its use of the Services; ii. execution, delivery, and performance of this Contract has been duly authorized and shall not conflict with any obligation of the Client, whether arising by contract, operation of law, or otherwise; iii. this Contract constitutes a valid, binding obligation of the Accountant; and iv. the Client has all rights necessary and power necessary to appoint the Accountant as its accounting agent. b. Representations by the Accountant: The Accountant represents and warrants that: i. it will comply with applicable law in its performance of the Services; ii. execution, delivery, and performance of this Contract have been duly authorized and shall not conflict with nature of the Client’s business, whether arising by contract, operation of law, or otherwise; iii. this Contract constitutes a valid, binding obligation of the Accountant; and iv. the Accountant has all rights, active licenses and authority necessary to provide the Services contemplated herein. 6. Confidentiality. Any confidential information (including all technology, processes, trade secrets, contracts, proprietary information; the nature of the information and the manner of disclosure are such that a reasonable person would understand it to be confidential) exchanged between the Accountant and the Client in connection with the performance of the Services shall be held by the Accountant in trust for the benefit of the Client only, and the Accountant will not divulge or authorize anyone to divulge during the term of this Contract, or any period thereafter, any information or knowledge acquired in the course of its performance. 7. Termination. This Contract may be terminated as follows: a. This Contract may be terminated by either party by giving 30 days advance written notice to the other party. b. Either party has the right to terminate this Contract where the other party becomes insolvent, fails to pay its bills when due, goes out of business, or there is a death of a party. c. If either party breaches any provision of this Contract and if such breach is not cured within thirty (30) days after receiving written notice from the other party specifying such breach in reasonable detail, the non-breaching party shall have the right to terminate this Contract by giving written notice thereof to the party in breach, which termination shall go into effect immediately upon receipt. 8. Notices. Any notices to be given under this Contract by either party to the other may be effected either by personal delivery in writing or by mail, registered or certified, postage prepaid with return receipt requested, email or facsimile. Mailed notices shall be addressed to the addresses of the parties as they appear in the introductory paragraph of this Contract, but each party may change the address by written notice in accordance with this paragraph. 9. Miscellaneous. a. Governing Law: This Contract shall be construed under and in accordance with the laws of _________________. b. Parties Bound: This Contract shall be binding on and inure to the benefit of the parties to this Contract and their respective heirs, executors, administrators, legal representatives, successors and assigns as permitted by this Contract. c. Indemnity. The parties each agree to indemnify and hold harmless the other party, its respective affiliates, officers, agents, employees, and permitted successors and assigns against any and all claims, losses, damages, liabilities, penalties, punitive damages, expenses, reasonable legal fees and costs of any kind or amount whatsoever, which result from the negligence of or breach of this Contract by the indemnifying party, its respective successors and assigns that occurs in connection with this Contract. This section remains in full force and effect even after termination of the Contract by its natural termination or the early termination by either party d. Severability: If one or more of the provisions contained in this Contract shall for any reason be held invalid, illegal, or unenforceable in any respect, that invalidity, illegality, or unenforceability shall not affect any other provision. This Contract shall be construed as if the invalid, illegal, or unenforceable provision had never been contained in it. e. Prior Contracts Superseded: This Contract constitutes the sole and only agreement of the parties and supersedes any prior understandings or written or oral agreements between the parties respecting the subject matter of this Contract. f. Entire Agreement: This instrument contains the entire agreement between the parties relating to the rights granted and the obligations assumed in it. Any oral representations or modifications concerning this instrument shall be of no force or effect except any amendment by the parties by a written agreement. g. Attorneys’ Fees: If any action at law or in equity is brought to enforce or interpret the provisions of this Contract, the prevailing party will be entitled to reasonable attorneys’ fees in addition to any other relief to which that party may be entitled. CLIENT: ________________________ [Client Name] [Client Address] [Client Address] [Client Phone] [Client Email] ACCOUNTANT: ________________________ [Accountant Name] [Accountant Address] [Accountant Address] [Accountant Phone] [Accountant Email] SCHEDULE “A” ESTIMATE FOR ACCOUNTING SERVICES TO BE PERFORMED

Frequently Asked Questions

What is an accounting contract?

An accounting contract is an agreement between two parties, usually a company and an accountant or an individual to provide accounting services. It outlines the responsibilities of both parties as well as the terms and conditions.

What is in an accounting contract template?

How long are accounting contracts good for?

It is important to specify the length of terms so all parties can be in agreement before signing the accounting contract.

Do accountants have contracts?

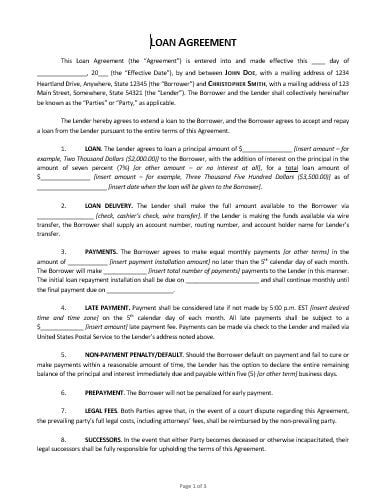

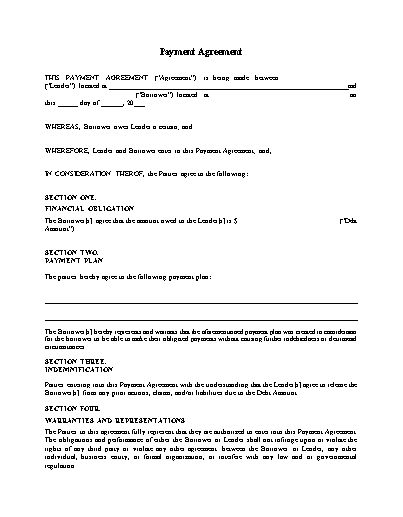

How do you draft a payment agreement?

The first step is to create a template that includes all details like date, amount, currency type and other relevant information. Once you have created your template you can customize it with the data for your specific agreement. The final step is to present it to your client and get their approval before you send it out to be signed.

What is a contract payment?

- Fixed payment. A fixed fee for a specific task or project.

- Commission. The percentage of sales that an individual earns on behalf of the company they represent.

- Hourly rate. The amount paid per hour for an employee’s services.

What does a contract accountant do?

Contract accountants are often hired to help with financial reporting and compliance requirements, such as tax preparation and filing, payroll, and financial statement preparation.

How much should I charge for bookkeeping?

The best way to figure out what to charge is to research what other accountants in your area charge. You can also ask other accountants for their rates and compare them.

What is a free accounting contract template?

You can download the free accounting contract template right on this page and being by customizing it with your information.

Who needs a free accounting contract template?

How to write a free accounting contract template

We want you to protect your business and yourself with high-quality, ready-to-sign contract and agreement templates. You can access this free accounting contract template using the Download Contract button on this page.

What must a free accounting contract template have?

The template should include all of the necessary information, like the name of the company, type of services offered, duration and cost. It is also important to include provisions for termination and confidentiality clauses.

What should I put in my free accounting contract template?

- Parties involved in the agreement (both parties must have signatures)

- Term of agreement

- Services rendered during the term of agreement

- Price per service rendered

How to make a free accounting contract template

There are many benefits to having a free accounting contract template. For one, it helps protect both parties by outlining the responsibilities of each party in the agreement. It also helps ensure that all terms and conditions are covered in the event that something goes wrong, like if there is a dispute over payment or if one party did not fulfill their end of the bargain.

How long are free accounting contract template good for?

The accounting contract template on this page allows you to define the length of the terms in the Contract Term section, so you can make sure it includes what you need.

What are some free accounting contract template examples?

Do free accounting contract template’s have to be in writing?

It is always smart to have all of your agreements in writing to prevent disputes and misunderstandings. This is a benefit to all parties, because they have agreed on the terms and conditions written out and can be held accountable for their individual responsibilities.

Send Contracts in Minutes

Unlock the power of WP E-Signature on your website using your branding today!

Get Started Now